Staff Reporter :

The depletion of Bangladesh’s foreign exchange reserves has raised concerns as the usable amount has fallen below the critical threshold of $13 billion, equivalent to less than three months’ worth of import liabilities.

With the country spending approximately $5 billion per month to settle import bills, the recent dip in usable reserves is alarming.

Recent data from the Bangladesh Bank reveals that a significant portion of reserves, amounting to $1.63 billion, was utilized to clear import bills for the months of March and April, particularly to the Asian Clearing Union (ACU).

According to Bangladesh Bank data, while the total reserves currently stand at $23.77 billion, the usable amount has decreased to $13.76 billion.

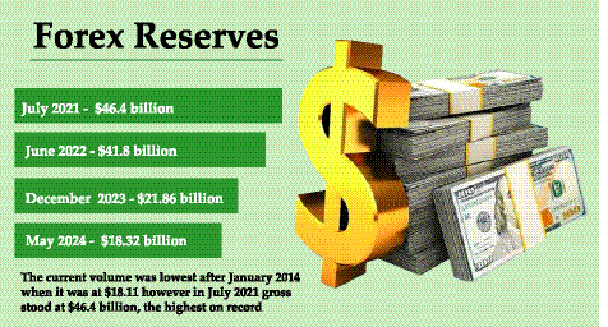

Calculated using the IMF prescribed BPM6 method, the reserves hit a 10-year low at $18.32 billion, as per the latest data released on May 12.

Comparatively, on April 30, the foreign exchange reserve stood at $19.97 billion, and $21.86 billion on December 28, 2023. This current volume marks the lowest since January 2014, when reserves were recorded at $18.11 billion. In contrast, in July 2021, gross reserves peaked at $46.4 billion,

marking the highest on record. During the current fiscal year of 2023-24, Bangladesh Bank has sold more than $12 billion from its forex reserves to banks in a span of ten and a half months.

Earlier, from July to December of the fiscal year, the depletion amounted to $6.7 billion, crossing $11 billion by April 22, according to central bank data.

Over the past 34 months, the Bangladesh Bank has sold approximately $32.79 billion, including $13.5 billion in FY23 and $7.62 billion in FY22, from its foreign exchange reserves to banks.

The reserves stood at $41.8 billion on June 2022 and $46.2 billion in September 2021.

Mezbaul Haque, the spokesperson of Bangladesh Bank, attributed the recent fall in reserves to the payment of import bills in the last two months.

Looking ahead, the spokesperson mentioned the disbursement of an IMF loan installment next month and anticipated income from expatriates will exceed $2 billion this month. It would increase the inflow of dollars and relax the pressure on reserves.

Meanwhile, the deficit in the country’s financial account continues to widen , crossing $9 billion in the first nine months of the current fiscal year amid a higher outflow of greenback than inflow, intensifying pressure on foreign exchange reserves.

In July-March of FY24, the deficit stood at $9.25 billion, more than three times higher compared to the $2.9 billion in the same period of FY23, according to the central bank’s latest data.

The financial account, which consists of the secondary income of a country – foreign direct investment, short-term and long-term loans, aid, and trade credit – has remained negative for the past two years, compelling the central bank to make foreign payments directly from the reserves.

The financial account plays a role as the secondary source from which a country can make foreign payments. When a country’s current account balance turns negative, it uses the financial account for foreign payments. If the financial account becomes negative, payments are made directly from reserves.

Bangladesh Bank recent data also showed that trade credit, a major component of the financial account, became negative at $12.2 billion in July-March of FY24 compared to $3.9 billion in the corresponding period a year earlier.

The trade-credit figure reflects that $12.2 billion in export proceeds remained pending with buyers, indicating that exporters’ repatriation is slow.

In contrast, Bangladesh Bank’s balance of payment figures reveal that short-term loan inflow was negative at $1.7 billion from July to March, implying that banks paid back more than they received because private sector enterprises were unwilling to accept foreign funding in the face of import restrictions.