Default loans hit record Tk6.44 lakh crore in September

Staff Reporter :

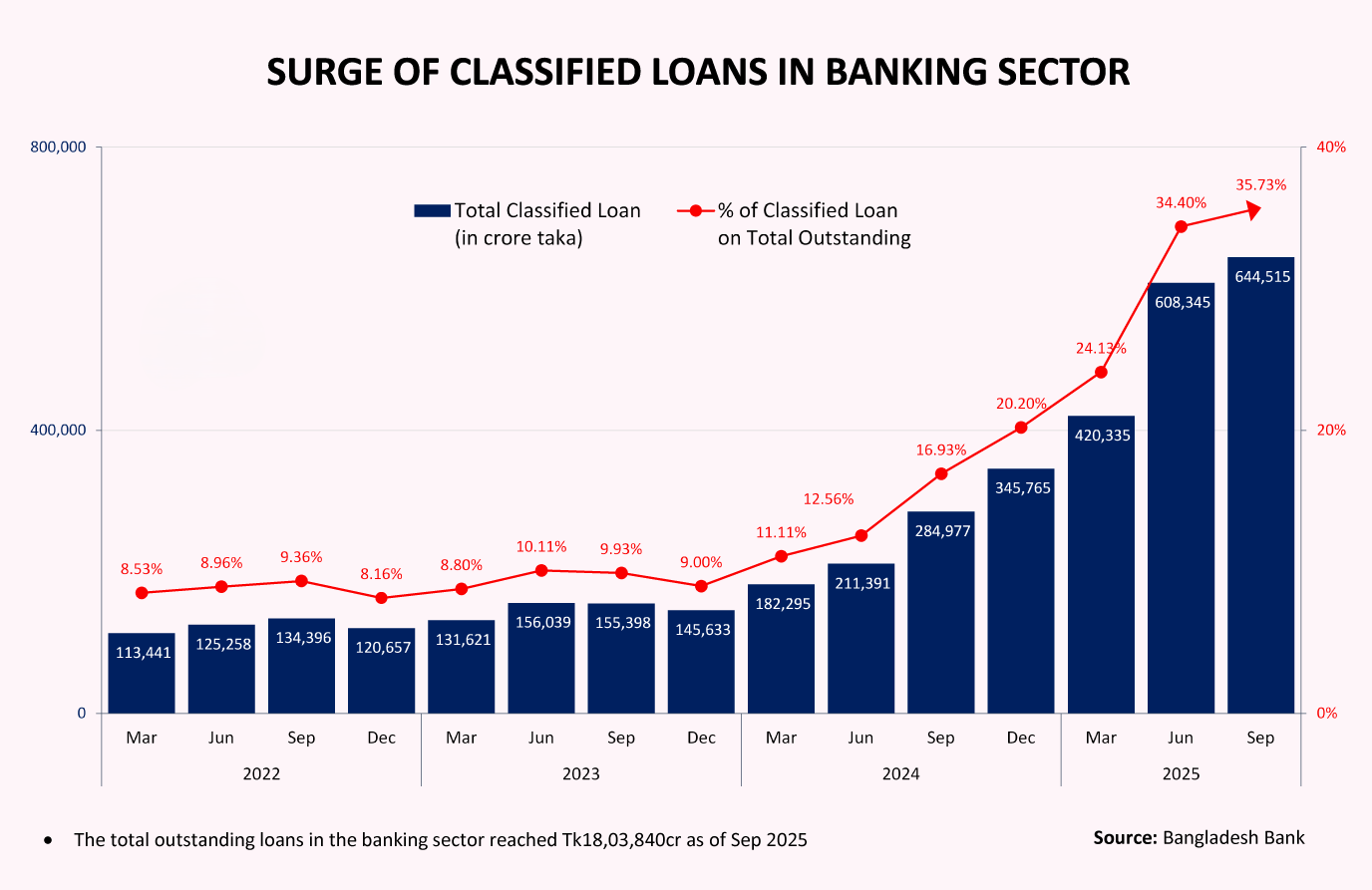

The banking sector of the country has witnessed an unprecedented escalation in defaulted loans, which ballooned by Tk2.24 lakh crore within just six months to stand at Tk6.44 lakh crore by the end of September.

According to Bangladesh Bank figures released on Wednesday, the share of default loans in the total credit portfolio surged to 35.73poercent in September—up sharply from 24poercent in March. The banking sector’s total outstanding loans currently amount to Tk18 lakh crore.

Defaulted loans, which were Tk2.85 lakh crore in September last year, more than doubled in the span of a year to reach the current Tk6.44 lakh crore.

The central bank noted that default loans were Tk4.20 lakh crore as recently as March.

A Bangladesh Bank infograph illustrates the dramatic rise in classified loans, which climbed to 35.73poercent of all outstanding loans by September 2025.

The sector has been facing mounting pressure since December last year, following revelations of widespread loan irregularities and corruption tied to the previous regime.

Central bank data shows defaults jumped nearly Tk3 lakh crore in the first nine months of this year, compared to Tk3.45 lakh crore recorded in December.

Industry insiders say the sharp increase is also linked to the implementation of stricter loan classification rules starting in March.

Under the revised framework, borrowers become classified immediately after the instalment due date lapses—placing an account under classification after just three months of non-payment. Previously, an overdue loan was not classified until nine months had passed.

The Bangladesh Bank reverted to its 2012 classification standards by shortening the overdue period by six months, a move aligned with the International Monetary Fund’s conditions under its $4.7 billion loan programme.

Central bank data also shows the provision shortfall rose to Tk3.44 lakh crore at the end of September this year.