NPLs hit record high of Tk 3.45 lakh crore

Muhid Hasan :

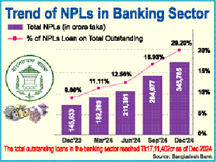

The total volume of non-performing loans (NPLs) in the country’s banking sector has surged to Tk 3,45,765 crore by the end of the October-December quarter (Q4) last year, which represents 20.2 per cent of the total outstanding loans.

According to Bangladesh Bank statistics released on Wednesday, the banking system had a total of Tk 17,11,402 crore in outstanding loans and advances at the end of the last quarter of 2024.

Earlier, in the third quarter (July-September) of 2024, NPLs had reached Tk 2,84,977 crore, marking an increase of Tk 61,000 crore in just three months.

Furthermore, the amount of NPLs at the end of 2023 was Tk 1.45 lakh crore, indicating a worrying rise of Tk 2 lakh crore in defaulted loans within a single calendar year.

Sector insiders said that during the tenure of the ousted Awami League (AL) government, influential individuals were granted large loans from banks under various special privileges.

For a long time, there have been allegations that a significant portion of this money was siphoned off in the form of defaulted loans and laundered abroad, all under state patronage.

There was a consistent failure to adhere to basic governance standards and credit discipline, both by the boards and management, due to political pressure, they expressed,

Additionally, various policies were implemented to artificially lower the reported volume of defaulted loans. Following the change in government, the central bank has moved away from these policies, which has contributed to the current rise in NPLs.

The failure to repay loans by several large business conglomerates, many of which were linked to the previous government, has led to the historic high in NPLs, they added.

When the Bangladesh Awami League assumed power in 2009, the amount of defaulted loans in the country was Tk 22,481 crore. Since then, bad loans have seen a steep rise over the last 15 and half years.

By June 2012, the figure stood at Tk 42,725 crore, and in March 2019, for the first time, NPLs in the country’s banking sector crossed the Tk 1 lakh crore mark, reaching Tk 1.09 lakh crore.

At the end of June (Q2) last year, the total volume of NPLs in the banking sector was Tk 2,11,391 crore.

During a press briefing, the Governor of Bangladesh Bank, Dr Ahsan H. Mansur, explained yesterday that the rise in NPLs is largely due to long-standing opacity in the reporting of bad loans and changes in loan classification policies. Previously, loans were classified as overdue after 270 days, but this timeframe has now been reduced to 180 days. Starting in April 2025, loans will be classified as non-performing within just 90 days.

He also noted that the ratio of bad loans would continue to rise in the coming days, as the central bank is committed to revealing the true state of the banking sector and eliminating the “culture of hiding” bad loans.

As of December 2024, at least 42 per cent of the total loans in state-owned banks were classified as non-performing, while 15 per cent of total loans in private banks were non-performing, according to the central bank data.

A previous study by the Centre for Policy Dialogue (CPD) estimated that between 2008 and 2023, under the Hasina regime, around Tk 92,261 crore was embezzled in 24 major banking scams. This embezzled amount is equivalent to 12 per cent of Bangladesh’s national budget for FY24 or 2 per cent of the country’s gross domestic product for FY23.

Veteran economist and academic Prof Muinul Islam told The New Nation that the real situation is still not fully reflected in the central bank’s latest statistics.

He estimates that the actual amount of defaulted loans in the banking sector has surpassed at least Tk 6 lakh crore.

Nearly one-third of this amount is tied up in lawsuits and is not classified as defaults on banks’ balance sheets, as long as the cases remain unresolved, he added.

Professor Muinul Islam also pointed out that the total write-offs by banks had risen to around Tk 67,000 crore, a situation that needs to be addressed. Considering the broader context, he estimated that more than one- third of the loans disbursed have now become defaulted.