ACU payment pushes gross reserves below $21b

Staff Reporter :

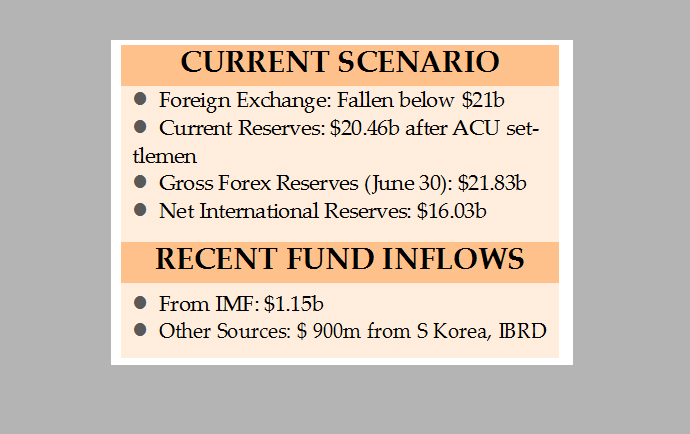

Bangladesh’s foreign exchange reserves have fallen below $21 billion following the Bangladesh Bank’s settlement of import bills through the Asian Clearing Union (ACU).

A senior official from the Bangladesh Bank stated that $1.42 billion in import payments for May and June were cleared this week through the ACU. As a result, reserves have decreased to $20.46 billion.

The ACU facilitates the settlement of payments for intraregional transactions among eight countries, including Bangladesh, Bhutan, India, Iran, Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka. India is one of Bangladesh’s largest trading partners within this arrangement.

On June 30, the gross forex reserves, calculated using the IMF’s BPM6 method, stood at $21.83 billion. The net international reserves were reported at $16.03 billion, according to data from the Bangladesh Bank.

Bangladesh received $1.15 billion from the IMF last month, along with

approximately $900 million from other sources such as South Korea and the International Bank for Reconstruction and Development (IBRD).

Amid the restrictions brought on by the COVID-19 pandemic, import payments, international travel, and the outflow of foreign currency for other purposes fell drastically. Concurrently, remittance inflows increased, driving the reserves to a record $48 billion in August 2021. However, as import payments began to rise and the economy gradually reopened, the reserves started to decline.

Despite the decline in import payments, the central bank has continued injecting dollars into banks. This continued intervention is occurring despite various import control measures introduced since April 2022. These measures resulted in a 12.59 percent year-on-year decline in the settlement of letters of credit (LCs), which reflect actual import payments, standing at $49.34 billion during July to March of FY24, according to Bangladesh Bank data.

The central bank’s ongoing dollar injections into banks have contributed to the reserves falling to risky levels.

Since August 2021, Bangladesh’s foreign exchange reserves have fallen by $24 billion. The central bank has been actively injecting dollars into banks to address various economic challenges. Specifically, the Bangladesh Bank pumped $7.62 billion into banks in FY22, a record $13.58 billion in FY23, and $12.79 billion in FY24.

In the just-concluded 2023-24 fiscal year, the Bangladesh Bank injected $12.79 billion into banks from its reserves as banks faced a severe US dollar crisis, which hampered import payments.