Wages fail to keep pace with cost of living

Muhid Hasan :

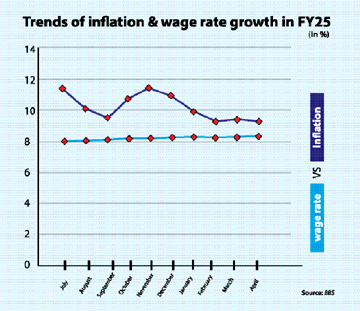

For 39 consecutive months, wage growth for the working class in Bangladesh has remained below the general inflation rate, eroding real incomes and reducing consumer purchasing power, according to data from the Bangladesh Bureau of Statistics (BBS).

Since February 2022, inflation has consistently outpaced nominal wage increases for both skilled and unskilled labourers across sectors. In July of the current fiscal year 2024-25, the gap between inflation and wage growth reached a concerning 3.73 percentage points. That month, inflation rose to a 12-year high of 11.66 percent, while nominal wage growth stood at just 7.93 percent.

The BBS estimates average monthly wages using data from 63 occupations-comprising 17 in agriculture, 30 in industry, and 16 in services. Its data reveals a persistent inflationary trend throughout FY25. In Q1, headline inflation stood at 10.49 percent in August and 9.9 percent in September, while wage growth lingered at 7.93, 7.96, and 8.01 percent for the three months, respectively.

In Q2 of FY25, year-on-year inflation remained elevated, averaging 11.1 percent. November recorded the second-highest inflation level of the fiscal year at 11.4 percent, followed by 10.9 percent in December. Wage growth during the same period was just 8.1 percent-failing to bridge the gap and thereby continuing to suppress purchasing power.

Although inflation eased slightly during Q3 (January-March FY25) to an average of 9.5 percent, wage growth still failed to keep pace, sustaining pressure on real income and household consumption.

According to BBS, Bangladesh has seen inflation remain above 9 percent for the past 26 months. In April 2025, inflation stood at 9.17 percent, while the gap with average monthly wage growth was still 98 basis points.

Historical data also underscores the trend. In FY2023-24, the average wage growth was 7.74 percent, while overall inflation reached 9.73 percent. Similarly, in FY2022-23, the inflation rate climbed to 9.02 percent compared to a wage growth rate of only 7.02 percent.

This sustained gap has significantly impacted low-income groups. A study by the Research and Policy Integration for Development (RAPID) revealed that prolonged inflation since 2022 has pushed an additional 7.9 million people below the poverty line, bringing the total number of poor individuals to 38.2 million. A further 9.8 million are at risk of falling into poverty, while 3.8 million have slid into extreme poverty.

Meanwhile, Bangladesh’s unemployment rate has surged amid economic and political uncertainty. According to BBS’s latest Labour Force Survey, the jobless rate climbed to 4.63 percent during October-December FY25-its highest in recent years. The number of unemployed rose to 2.73 million, an increase of 330,000 compared to the same period the previous year, under a revised methodology based on the 19th International Conference of Labour Statisticians (ICLS).

Dr Zahid Hussain, former lead economist of the World Bank’s Dhaka office, told The New Nation that real wages have declined since 2022, primarily due to a downward trend in investment driven by heightened political uncertainty. He noted that while the gap between inflation and wage growth has narrowed slightly in recent months, sustainable wage growth remains unlikely without renewed investor confidence and a stable economic environment.

Veteran economist Professor Dr Muinul Islam expressed concerns over the reliability of official data, claiming that BBS figures on inflation and wage growth were subject to manipulation under the previous regime. “The rising cost of essential goods is not fully reflected in the official inflation rate, while wage growth data appears artificially inflated,” he said.

Dr Islam urged the interim government to adopt comprehensive policy measures aimed at fostering an investment-friendly climate and ensuring equitable economic reforms to reverse the decline in real income for the working class.