Al Amin :

The government borrowing from internal and external sources has been estimated to increase heavily to meet the budget deficit in the upcoming fiscal year (2024-25), according to the finance ministry.

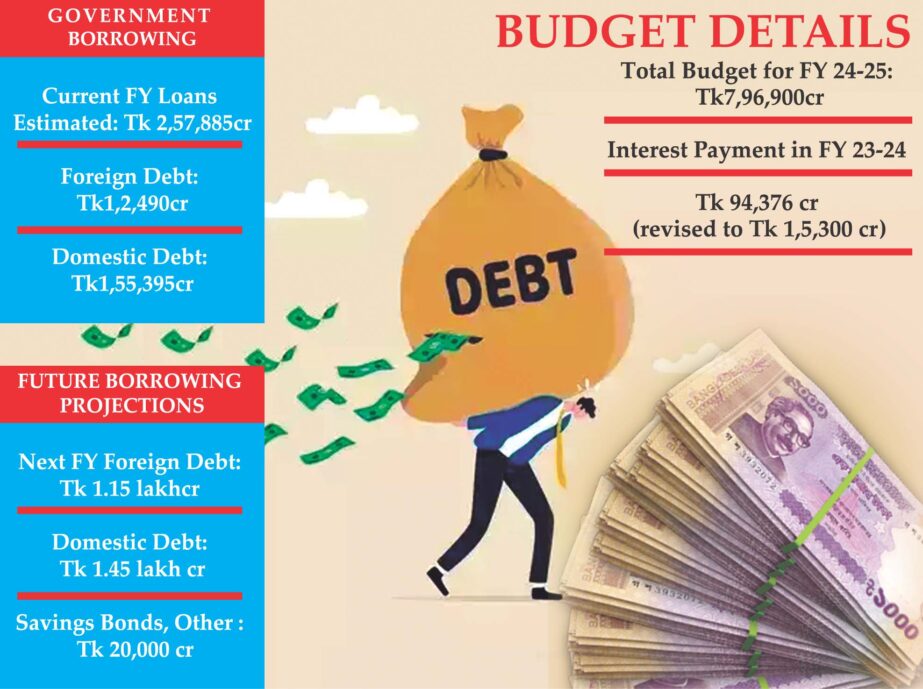

They said like the current fiscal year, the government is going to borrow a huge amount from the two sources and the estimated expenditure for only interest payment will be Tk 1.16 lakh crore from the total budget in the next FY.

The next budget worth Tk796,900 crore will be placed in the parliament on June 6.

The interest payment will be increased by Tk 21,624 crore in the next fiscal year compared to the current fiscal year (2023-24).

The allocation for the interest payment was Tk 94,376 crore in the main budget of the current FY, but later, it was revised to Tk 15,300 crore.

Economists said that the interest payments have increased in the current fiscal year due to the devaluation of the local currency against the US dollar, the surge in interest rates and the increase in the amount of debts.

The unusual surge in interest payment is dragging down the country’s economy, they added.

The ministry sources said the overall loans were estimated to Tk 257,885 crore for the current Fiscal year.

Of the amount, the net foreign debt from various development partners and countries was Tk 12,490 crore and the domestic debt was Tk 155,395 crore.

A major part of the domestic loans comes through banking sources and it was estimated at Tk 132,395 crore in the current fiscal year and the rest was projected to come from savings bonds and other sources.

In the coming fiscal year, the net foreign debt is estimated to Tk 1.15 lakh crore and Tk 1.45 lakh crore is projected to come from the banking system to finance the budget deficit, the ministry sources said.

And the remaining Tk 20,000 crore will be taken from the sale of savings bonds and other sources, they added.

Dr Zahid Hussain, former lead economist of the World Bank Dhaka office, told The New Nation, “The country’s economy is already under pressure due to the dollar crisis and the pressure will intensify further due to the surge in interest payment.”

“On the other hand, the installments of foreign loans for some big projects will start from this year. But, the earnings from exports and remittances are not increasing as required,” he added.

If the supply of dollars is not increased in such a situation, the crisis surrounding the foreign debt may intensify further, he observed.