Tax-free income limit unchanged

Staff Reporter :

Amid persistent high inflation and shrinking real incomes, the government has decided to keep the annual tax-free income threshold for individual taxpayers unchanged at Tk 3.5 lakh for the 2025-26 fiscal year.

Finance Adviser Dr. Salehuddin Ahmed made the announcement while presenting the proposed income tax structure in a pre-recorded televised speech while it was aired on Betar as well. The decision has sparked concern among the public, as living costs continue to rise.

“At present, the tax-free income threshold for individual taxpayers is Tk 350,000. To reduce the tax burden on low-income groups, ensure social protection and fairness, and keep pace with inflation, the tax-free income threshold for individual taxpayers has been increased to TK 375,000 for the assessment years 2026-2027 and 2027-2028,” he said.

He also said, “Currently, the minimum tax payable by individual and Hindu Undivided Family taxpayers ranges from TK 3,000 to TK 5,000 depending on location. For the assessment years 2026-2027 and 2027-2028, if total income exceeds the tax-free limit, a flat minimum tax of TK 5,000 will apply regardless of location.”

Although no immediate relief has been offered for general taxpayers, a significant change has been proposed at the upper end of the tax structure.

A new income tax slab has been introduced, imposing a 30 percent tax rate on individuals whose annual income exceeds Tk 38.5 lakh. The existing tax slabs have also been restructured under the new proposal.

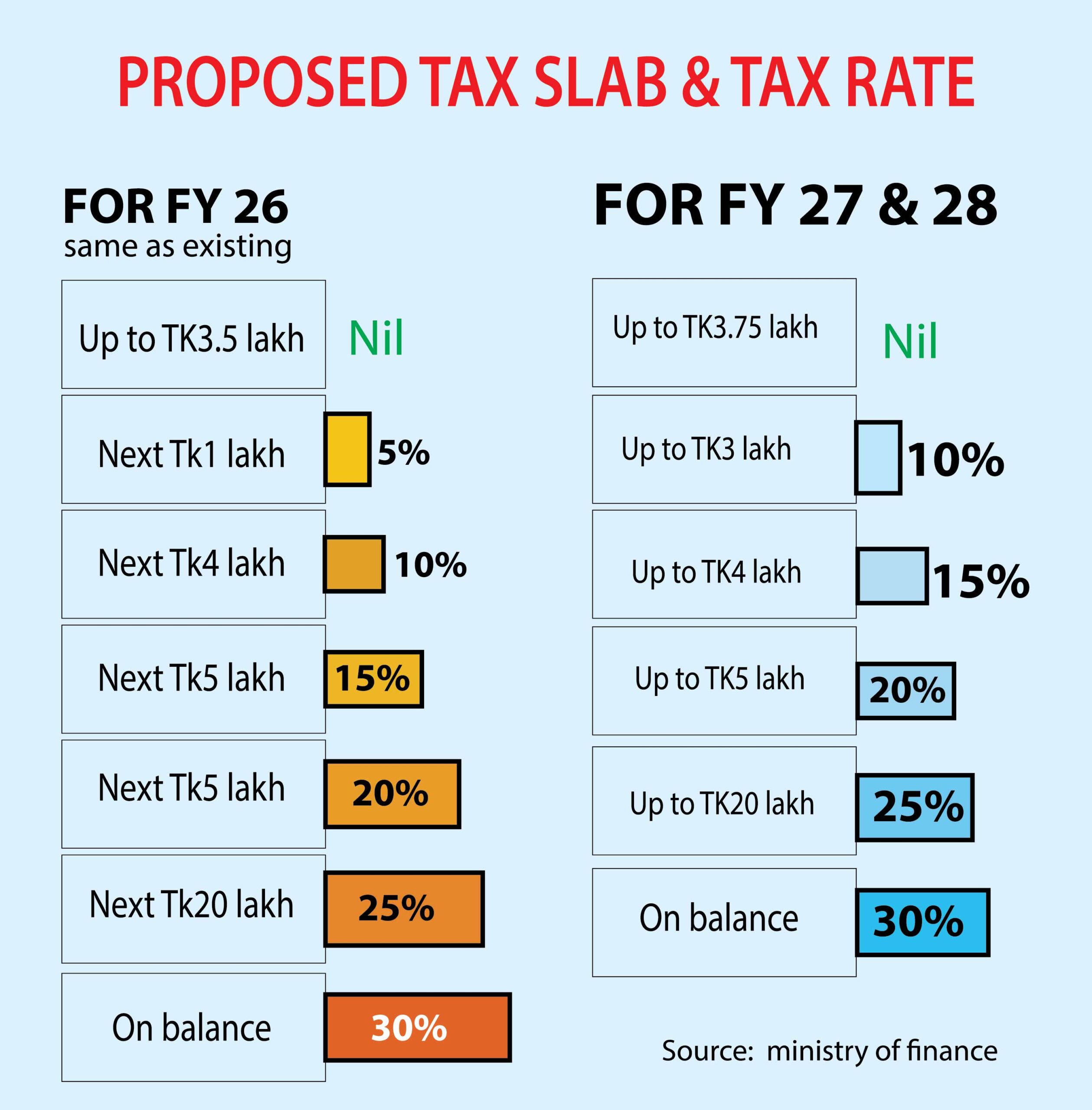

According to the new structure, income beyond the tax-free threshold of Tk 3.5 lakh will be taxed at progressive rates: 5 percent on the next Tk 1 lakh, 10 percent on the following Tk 4 lakh, 15 percent on the next Tk 5 lakh, 20 percent on the next Tk 5 lakh, and 25 percent on the subsequent Tk 20 lakh. Any income exceeding these amounts will fall under the new 30 percent tax bracket.

The Finance Adviser also announced that beginning in the 2026-27 fiscal year, and continuing through 2027-28, the tax-free income limit will be increased by Tk 25,000, bringing it to Tk 3.75 lakh. A proposal to reorganize the tax slabs will accompany this change.

Special provisions have been made for certain groups. The tax-free income limit will be Tk 4 lakh for women and individuals over the age of 65. For third-gender taxpayers and persons with disabilities, the threshold will be Tk 4.75 lakh.

Gazetted freedom fighters will enjoy a tax-free income limit of Tk 5 lakh. Additionally, the parents or legal guardians of persons with disabilities will receive an extra Tk 50,000 in tax-free income for each dependent with disabilities.

Injured participants of the July 2024 mass uprising, recognised by government gazette, will be entitled to a tax-free income limit of Tk 5.25 lakh starting from the 2026-27 fiscal year.

A minimum tax of Tk 1,000 has been proposed for new taxpayers. Once an individual’s income crosses the tax-free threshold, they will be required to pay at least this amount.

“To foster a culture of tax compliance, expand the tax net, and encourage new taxpayers, the minimum tax for new taxpayers has been set at TK1,000,” Finance Adviser said. Currently, the minimum tax for residents in Dhaka North City, Dhaka South City, and Chattogram City is Tk 5,000. For other city corporation areas, the minimum is Tk 4,000, while in non-city corporation areas, it is Tk 3,000.

According to the National Board of Revenue (NBR), there are around 11.1 million TIN (Tax Identification Number) holders in the country. In the current fiscal year, approximately 4 million taxpayers have submitted their returns.

Amid rising inflation, concerns have grown over the government’s decision to maintain the current tax-free threshold. Over the past year, average inflation has remained above 10 percent, leading to a sharp increase in the cost of living.

The Finance Adviser also said that in order to make tax compliance easier, the 2.5 per cent reduced corporate tax rate benefit for listed companies has been made more accessible. Instead of requiring all income, expenses, and investments to be transacted via bank transfer, now only income must be transacted through bank transfer to qualify for the reduced rate.