Power tariff shift risks driving investors away

Staff Reporter :

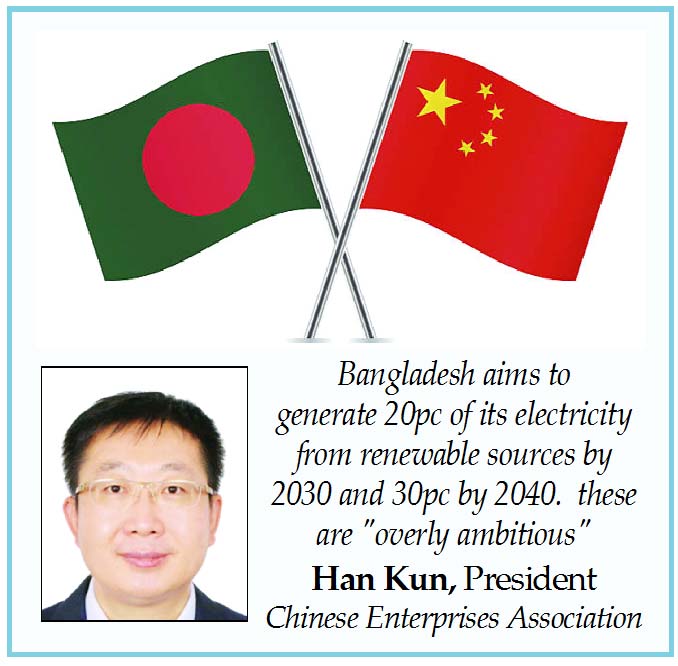

Han Kun, President of the Chinese Enterprises Association (CEA) in Bangladesh, has warned that the government’s decision to renegotiate tariffs in the power sector poses a serious threat to investor confidence.

Speaking at the 3rd Bangladesh-China Renewable Energy Forum, held in Dhaka on 30 June, Han described the policy shift as “a disaster for investors.”

“When we completed our investment and the plant was ready for commercial operation, we were abruptly informed that the tariff structures would be changed.

Altering the terms and conditions at such a late stage is highly disruptive and discouraging for those who have already invested in power projects,” Han said during the dialogue, which focused on the challenges facing Chinese overseas investment in Bangladesh’s renewable energy sector.

The forum, organised by the Centre for Policy Dialogue (CPD), highlighted concerns over the government’s recent move to amend power purchase agreements (PPAs), with several flagship projects-including the 1320 MW Patuakhali plant, the Barishal coal-fired power plant, and the SS Power Plant-reportedly receiving notices for tariff renegotiation.

Han stressed that such unpredictability undermines long-term investor confidence and may deter future investments. “Globally, we’ve seen how abrupt changes in contractual terms increase project risks, raise financing costs, and delay energy transitions,” he cautioned.

He also alleged financial irregularities, citing the deduction of $1.45 million from payments to a Chinese-funded power project for a delayed performance bond, even though the PPA did not contain a relevant penalty clause. He further noted that the SS Power Plant has faced payment delays exceeding $200 million, while the Barishal plant has also encountered arbitrary deductions.

Bangladesh aims to generate 20 per cent of its electricity from renewable sources by 2030 and 30 per cent by 2040. However, Han called these targets “overly ambitious,” given the current contribution of just 3 per cent from grid-connected renewables.

The CPD’s keynote presentation identified major impediments to foreign investment, including complex administrative processes, difficulties in land acquisition, and poor inter-agency coordination.

Presenters Khondaker Golam Moazzem and Abrar Ahammed Bhuiyan noted that partial digitalisation, excessive licensing requirements, and limited English-language resources continue to frustrate investors.

“While some services are online, many processes still require in-person visits and paper documentation. The lack of integration across digital platforms adds to the confusion,” said Moazzem.

Further concerns were echoed by other industry representatives. Wang Weiquan, Deputy Secretary General of the Chinese Renewable Energy Industries Association, contrasted Bangladesh’s approach with China’s, highlighting fixed tariffs, long-term policy frameworks, and investment incentives as key enablers in China’s renewable energy development.

Md Shahidur Rahman, Country Manager of Jinko Solar Bangladesh, stressed the need for government-facilitated land acquisition for solar projects-a practice followed in countries like India, Brazil, and several African nations. He also flagged the issue of substandard and unauthorised solar panel imports as a significant barrier to scaling solar capacity.

SK Md Ruhul Amin, Deputy Managing Director of Chint Solar Bangladesh, addressed the cancellation of Letters of Intent (LoIs) for 37 solar power plants, citing alleged corruption. “We followed due procedures, acquired land, and transferred funds, yet no clarification has been provided on the grounds for these cancellations,” he said.

Masudur Rahim, CEO of Omera Renewable Energy Ltd, underlined structural challenges in attracting foreign investment.

“In open tenders, the absence of termination clauses, lack of implementation agreements, no payment guarantees, and inconsistent tariffs discourage potential investors,” he said, adding that infrastructure development and streamlined repatriation of dividends are essential to regain investor confidence.

The forum was attended by Jalal Ahmed, Chairman of the Bangladesh Energy Regulatory Commission (BERC); Nahian Rahman Rochi of the Bangladesh Investment Development Authority (BIDA); Mohammad Alauddin, Rector of the Bangladesh Power Management Institute; and senior officials from SREDA and BPDB.