Pharma Industry: Patent barriers loom as Bangladesh exits LDC status

Farrukh Khosru and Reza Mahmud :

Bangladesh’s pharmaceutical industry faces the challenge of losing its Least Developed Country (LDC) status, expected in 2026.

This transition may result in the loss of its ability to produce generic drugs without patent restrictions. While the European Union may grant a grace period, the industry must prepare for potential patent claims from global pharmaceutical firms.

Despite its successes, the sector continues to encounter challenges, including a heavy reliance on imports for Active Pharmaceutical Ingredients (APIs), with up to 85 per cent of its API demand still being met through imports from India and China.

The government has introduced initiatives to promote self-sufficiency in API production by incentivising local manufacturing; however, progress remains slow.

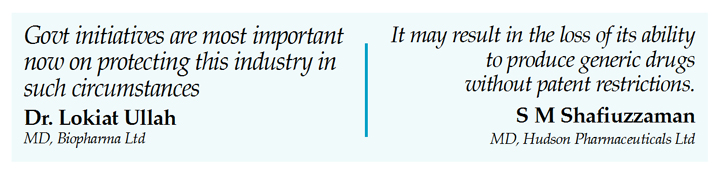

When contacted, Bangladesh Association of Pharmaceutical Industries (BAPI), former Secretary General and Managing Director of Hudson Pharmaceuticals Ltd, – S M Shafiuzzaman told The New Nation on Friday, “Pharmaceutical industry faces the challenge of losing its LDC status. It may result in the loss of its ability to produce generic drugs without patent restrictions.”

The Business leader also expressed anxiety saying Bangladeshi pharmaceuticals industry will face huge barriers to its constant growing exporting.

Dr. Lokiat Ullah, Managing Director of Biopharma Ltd. said, “After lossing LDC status, our pharmaceuticals industry will face huge challenges in exporting its products abroad.”

He said, government’s initiatives are most important now on protecting this industry in such circumstances.

Regulatory oversight in Bangladesh is more streamlined than in India, where a fragmented system has led to issues with drug quality.

The Directorate General of Drug Administration (DGDA) oversees licensing, market authorisation, and compliance with Good Manufacturing Practices (GMP).

However, Bangladesh has also faced incidents involving substandard drugs, including recent cases of adulterated anaesthetics and mass poisonings from contaminated syrups.

Following independence in 1971, Bangladesh struggled to ensure access to essential medicines, resulting in a market flooded with substandard products.

An expert committee established 16 criteria to evaluate and regulate pharmaceuticals, leading to the ban of 1,742 ineffective or non-essential drugs.

This policy faced significant opposition from multinational firms and local contractors; however, Bangladesh upheld its stance, becoming one of only 14 countries to introduce a National Drug Policy (NDP).

In May 1982, a committee of experts proposed a transformative NDP to the health ministry, aiming to overhaul the country’s drug regulation system.

At the time, Bangladesh was heavily reliant on pharmaceutical imports, with medicines being both expensive and often unsafe.

Approximately 75 per cent of pharmaceuticals were produced by just eight multinational companies, which sold their products at exorbitant prices.

The lack of adequate infrastructure further complicated access to medicines.

The NDP sought to address these issues by promoting the production of essential medicines, particularly antibiotics and antivirals while restricting the sale of ineffective combination drugs.

Previously, irrational medicines were widespread, but the NDP refocused the industry on rational, necessary treatments.

The NDP fostered self-reliance and improved drug affordability, allowing local firms to manufacture essential medicines under their own brands.

By 2014, the pharmaceutical sector’s turnover had grown from USD 100 million in the mid-1980s to nearly USD 2 billion.

A 2021 study found that drug prices in Bangladesh were among the lowest globally, with local prices sometimes ten times lower than in other countries.

Today, Bangladesh stands out as the only LDC with a thriving pharmaceutical industry, meeting nearly all domestic demand and exporting to over a hundred countries.

In 2022, the industry was valued at approximately USD 3 billion, having tripled in size over the past decade.

Official trade figures for 2023-2024 indicate export earnings of USD 205 million, with Myanmar, Sri Lanka, the United States, the Philippines, Afghanistan, and Kenya among the top destinations.

To sustain its growth, Bangladesh’s pharmaceutical sector may need to cultivate a culture of innovation, moving beyond generic production to develop new drugs.

A significant portion of pharmaceutical breakthroughs could emerge from this region rather than the West.

As the industry continues to evolve, Bangladesh may yet defy expectations and establish itself as a leader in global health.