Export blow feared as US eyes steep tariffs

Farrukh Khosru :

The Centre for Policy Dialogue (CPD) has issued a strong warning that Bangladesh could face significant trade losses if the United States implements its proposed Reciprocal Tariffs (RTs) under the Trump administration.

In a policy brief published on Sunday, the CPD estimates that a 37 per cent tariff-one of the highest among affected countries-could lead to a 56 per cent drop in Bangladeshi exports to the US, with a potential 9 per cent decline in the country’s global exports.

The think tank particularly highlighted the vulnerability of Bangladesh’s readymade garment (RMG) sector, which constitutes the bulk of the country’s exports to the US.

It cautioned that small and medium-sized enterprises (SMEs), which already operate on narrow profit margins and face increasing input costs, would be hardest hit.

Meanwhile, the government has confirmed that trade discussions with the US are ongoing.

At a press conference on Saturday, Energy Adviser Fouzul Kabir Khan stated that significant progress had been made, and that talks were now shifting to tariff and non-tariff issues. He noted that the US initially seeks a broader framework agreement covering trade and security issues.

The adviser added that discussions are expected to conclude before 1 August, with the government committed to protecting national interests.

When asked about US concerns around energy, he noted ongoing imports from US firms such as Excelerate Energy and Chevron but confirmed no specific discussion on LNG imports had yet taken place.

Environment Adviser Syeda Rizwana Hasan and Industries Adviser Adilur Rahman Khan also attended the briefing at the Energy Division in Dhaka.

The US is Bangladesh’s largest export destination and a major source of foreign direct investment (FDI). A steep tariff increase would not only threaten trade flows but also undermine bilateral economic relations, CPD observed.

The brief criticises the method used by the Trump administration to calculate the tariffs, calling it overly simplistic and lacking in nuance.

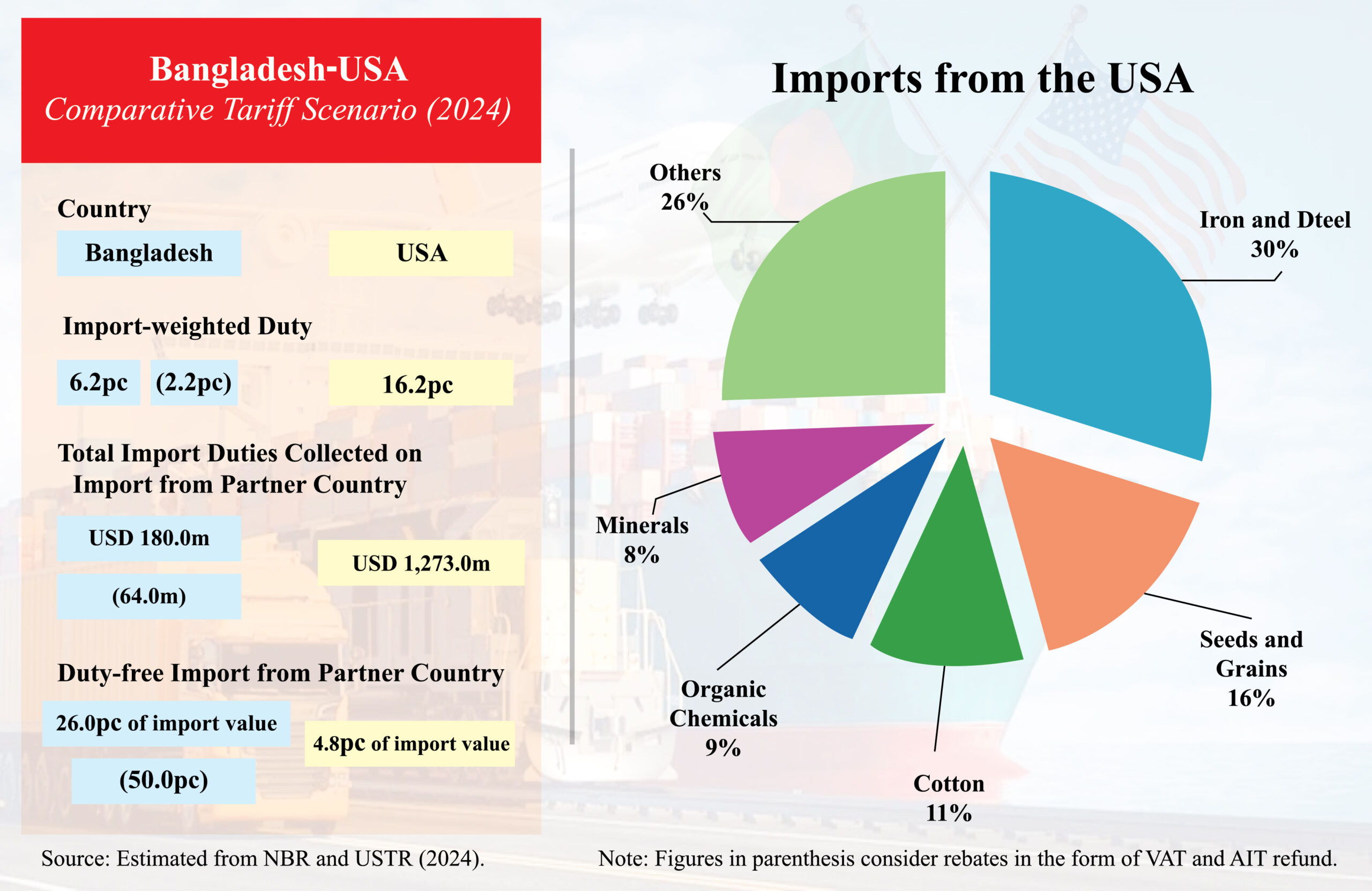

The formula is based on bilateral trade deficits and ignores wider economic and trade dynamics. CPD argues that the approach does not reflect true reciprocity. While Bangladesh’s import-weighted tariff on US goods is only 2.2 per cent (after rebates), the average US tariff on Bangladeshi imports-primarily garments-stands at 15.1 per cent.

In 2024, the US collected more than $1.2 billion in duties on Bangladeshi exports, nearly 17 times what Bangladesh collected on US goods.

The policy paper also warns that even the temporary 10 per cent tariff, currently under a 90-day pause, could reduce apparel exports to the US by 34 per cent. If the 37 per cent rate is imposed, RMG exports could plummet by 60 per cent, it says.

In response, the CPD recommends several strategic actions to mitigate the potential fallout. They include monitor competitor strategies, use the ticfa platform, evaluate mfn implications, explore an FTA with the us, negotiate cotton-based benefits, attract us investment, improve intellectual property protections, strengthen regional trade links and align with LDC graduation strategy.

Bangladesh should closely observe how trade competitors such as Vietnam, India, and Cambodia are negotiating with the US, and align its strategies accordingly.

The Trade and Investment Cooperation Forum Agreement (TICFA) should be used as the primary forum for negotiating tariff concessions and potentially initiating discussions on a bilateral free trade agreement (FTA) with the US.

Any tariff concession offered to the US must comply with the Most Favoured Nation (MFN) rules under the WTO. CPD warns that such concessions, if extended globally, could result in revenue losses exceeding $168 million.

Although previously hesitant, the US has shown recent willingness to discuss an FTA. CPD urges Bangladesh to revisit this proposal, but with careful preparation to ensure national interests and revenue streams are safeguarded.

Bangladesh could request preferential treatment for garments made from US-imported cotton. Proposals for local warehousing and deferred payment mechanisms could also enhance trade competitiveness.

Increasing US investment in Bangladesh would help reduce the bilateral trade deficit and align with the US’s focus on local content. A bilateral investment agreement could support this goal.

Strengthening enforcement in intellectual property rights (IPR) is essential to addressing US concerns and building trust for future negotiations.

Bangladesh should pursue regional FTAs and Comprehensive Economic Partnership Agreements (CEPAs), especially under BIMSTEC, to diversify export markets and reduce vulnerability.

CPD stresses that any trade strategy must support Bangladesh’s smooth transition from the Least Developed Country (LDC) category and be embedded in its broader economic development framework.

The CPD concludes its policy brief by urging the government to establish a fully resourced Negotiating Wing to handle evolving trade challenges, including the Trump tariff initiative, and to better coordinate strategies for LDC graduation and global economic integration.