NPLs hit record Tk 4.20 lakh crore as BB eliminates ‘Culture of Hiding’

Muhid Hasan :

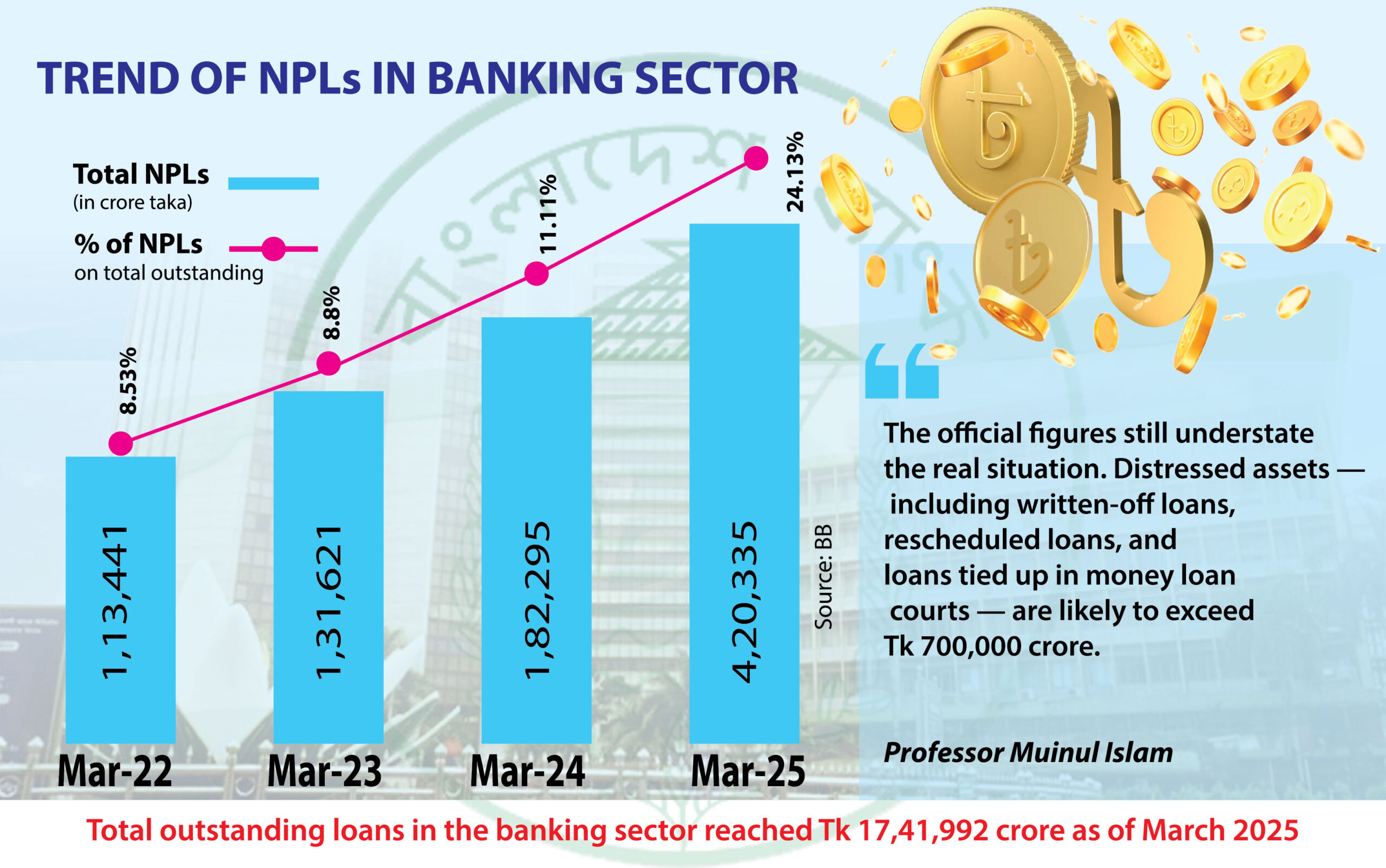

The volume of non-performing loans (NPLs) in Bangladesh’s banking sector has surged to Tk 420,335 crore by the end of the January-March quarter this year, representing 24.13 per cent of total outstanding loans, according to the latest data released by Bangladesh Bank (BB) on Sunday.

As of 31 March 2025, the total loans in the banking system stood at Tk 1,741,992 crore, up from Tk 1,711,402 crore at the end of the December 2024 quarter. NPLs increased sharply from Tk 345,000 crore (20.20 per cent of total loans) in December 2024, rising by Tk 74,570 crore over just three months.

Alarmingly, the figure marks a 131 per cent year-on-year increase, up from Tk 182,295 crore in the same period last year.

Industry insiders attribute the sharp rise partly to the central bank’s recent adoption of international standards for loan classification, which aims to present a more accurate picture of the sector’s health by ending the long-standing “culture of hiding” bad loans.

The surge in defaulted loans has been particularly pronounced since the political transition in August 2024, following widespread student protests that led to the fall of the previous Awami League government. During the former administration’s tenure, influential individuals allegedly secured large loans under preferential terms, contributing to rising defaults.

For years, critics have accused state patronage of facilitating large-scale bank loan fraud and money laundering abroad, with governance and credit discipline compromised due to political interference. Additionally, policies were reportedly implemented to artificially reduce the reported volume of bad loans.

Following the government change, the central bank has moved away from these practices. However, defaults by major business conglomerates linked to the previous regime have pushed NPLs to record highs.

When the Awami League first came to power in 2009, NPLs stood at Tk 22,481 crore. The figure doubled to Tk 42,725 crore by June 2012 and crossed the Tk 100,000 crore mark in March 2019, reaching Tk 109,000 crore for the first time. By December 2023, NPLs amounted to Tk 145,000 crore, representing 9 per cent of total loans, rising further to Tk 211,000 crore (12.56 per cent) by June 2024.

A prior study by the Centre for Policy Dialogue (CPD) estimated that approximately Tk 92,261 crore was embezzled in 24 major banking scams during the Awami League’s rule from 2008 to 2023 – an amount equivalent to 12 per cent of the national budget for FY2024 or 2 per cent of the country’s GDP for FY2023.

Veteran economist Professor Muinul Islam told The New Nation that the official figures still understate the real situation. He estimated that distressed assets – including written-off loans, rescheduled loans, and loans tied up in money loan courts – are likely to exceed Tk 700,000 crore.

Prof Muinul Islam also highlighted that total bank write-offs have increased to around Tk 67,000 crore, an issue requiring urgent attention. Taking the broader picture into account, he estimated that roughly 40 per cent of all outstanding loans have effectively become distressed assets.