Fiscal strain deepens with Tk 62,000cr power subsidy plan

Farrukh Khosru :

The third quarter of FY2025 (January-March 2025) presented a relatively stable period for Bangladesh’s power and energy sector, marked by steady electricity supply, particularly during Ramadan, and modest improvements in sectoral management.

However, underlying challenges persist, particularly around energy diversification and renewable energy progress.

Fiscal challenges continue to loom large over the sector. Defaults on import payments, mounting public debt, and a growing subsidy burden have exerted financial pressure.

The Ministry of Finance plans to increase subsidies for the power sector to Tk 62,000 crore in the FY2025-26 national budget. However, experts warn that this risks perpetuating a vicious cycle of overdue payments and financial instability unless structural reforms are introduced.

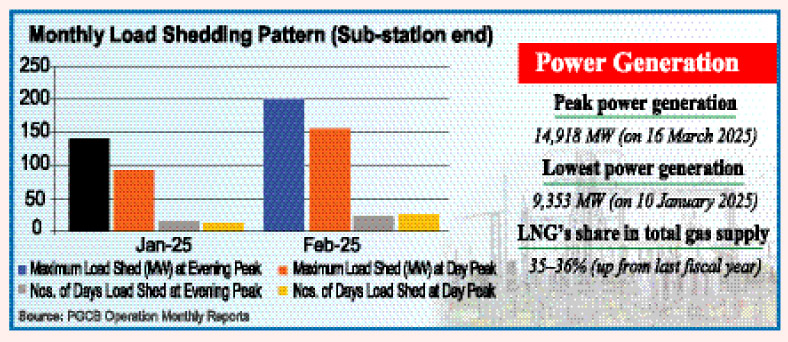

Peak power generation during the quarter reached 14,918 MW on 16 March, while the lowest recorded was 9,353 MW on 10 January. The government successfully curtailed widespread load shedding during Ramadan by relying heavily on oil and LNG-based generation. Nevertheless, the volatility in the global energy market led to significant fluctuations in the cost of oil-based power generation.

Despite political commitments towards a low-carbon future, Bangladesh’s energy strategy continued to emphasise imported LNG over domestic gas exploration.

Although the interim government demonstrated optimism regarding renewable energy development, no new renewable plants were added to the grid during this quarter, highlighting slow progress compared to earlier periods.

Several key initiatives were undertaken. A separate tariff structure for battery-swapping stations was introduced to encourage electric vehicle infrastructure investment.

The Bangladesh Energy Regulatory Commission (BERC) made several adjustments to LPG prices, reflecting responsiveness to global market shifts. Furthermore, construction of multiple solar power projects continued, albeit at a modest pace.

On the operational side, outstanding payments to the Adani Group and other energy suppliers were cleared, while spot LNG cargoes were secured to ensure fuel availability during the peak demand season. Measures were also initiated to curb illegal gas connections and to reinforce regulatory compliance for new power and energy projects.

The transmission network expanded by 4.32 per cent, reaching 16,788 circuit kilometres, while grid substation capacity rose slightly by 0.75 per cent. Distribution networks, however, remained stagnant. Load shedding, although relatively under control, saw a spike in February 2025 before easing in March, reflecting seasonal demand fluctuations and efforts by the government to ensure stability during Ramadan.

Despite moderate improvements in infrastructure, technical vulnerabilities remained. A significant incident occurred on 11 March 2025, when a malfunction at the Aminbazar substation led to a national grid collapse, affecting parts of Dhaka for over two hours.

Bangladesh’s dependence on LNG continued to deepen. During the quarter, LNG’s share in total gas supply rose to 35-36 per cent, significantly higher than the same period last fiscal year. Meanwhile, domestic gas supply further declined, with peak domestic output lower than in previous quarters.

Although the government plans a second international tender for offshore gas exploration, no substantive progress was observed this quarter.

In the renewable energy sector, while there was some progress in project construction, delays remained widespread.

Eight projects remained stalled, contributing to an estimated 394.5 MW shortfall in clean energy generation. Although Chinese company LONGi expressed interest in investing in Bangladesh’s solar energy sector, foreign investment remained limited during the quarter.

The Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) emerged as a strong advocate for energy transition within the industrial sector.

In an interview, BKMEA’s Executive President, Fazlee Shamim Ehsan, highlighted the organisation’s goal to green RMG factories by 2029 through rooftop solar installations and energy efficiency measures. He noted funding constraints and fiscal disincentives as major barriers to faster adoption of renewables.

However, the Centre for Policy Dialogue (CPD) flagged the need for reform in Bangladesh’s fuel pricing system. Their study showed that current fuel prices are artificially inflated due to outdated pricing formulas.

They proposed using Artificial Neural Network (ANN) models to move towards a market-based pricing regime, alongside carbon pricing policies and incentives for renewable energy adoption.

While Bangladesh’s power and energy sector showed signs of stabilisation during January-March 2025, long-term sustainability hinges on addressing systemic financial vulnerabilities, accelerating domestic gas exploration, and genuinely prioritising renewable energy.