Challenges mount for jute sector amid export decline

Muhid Hasan :

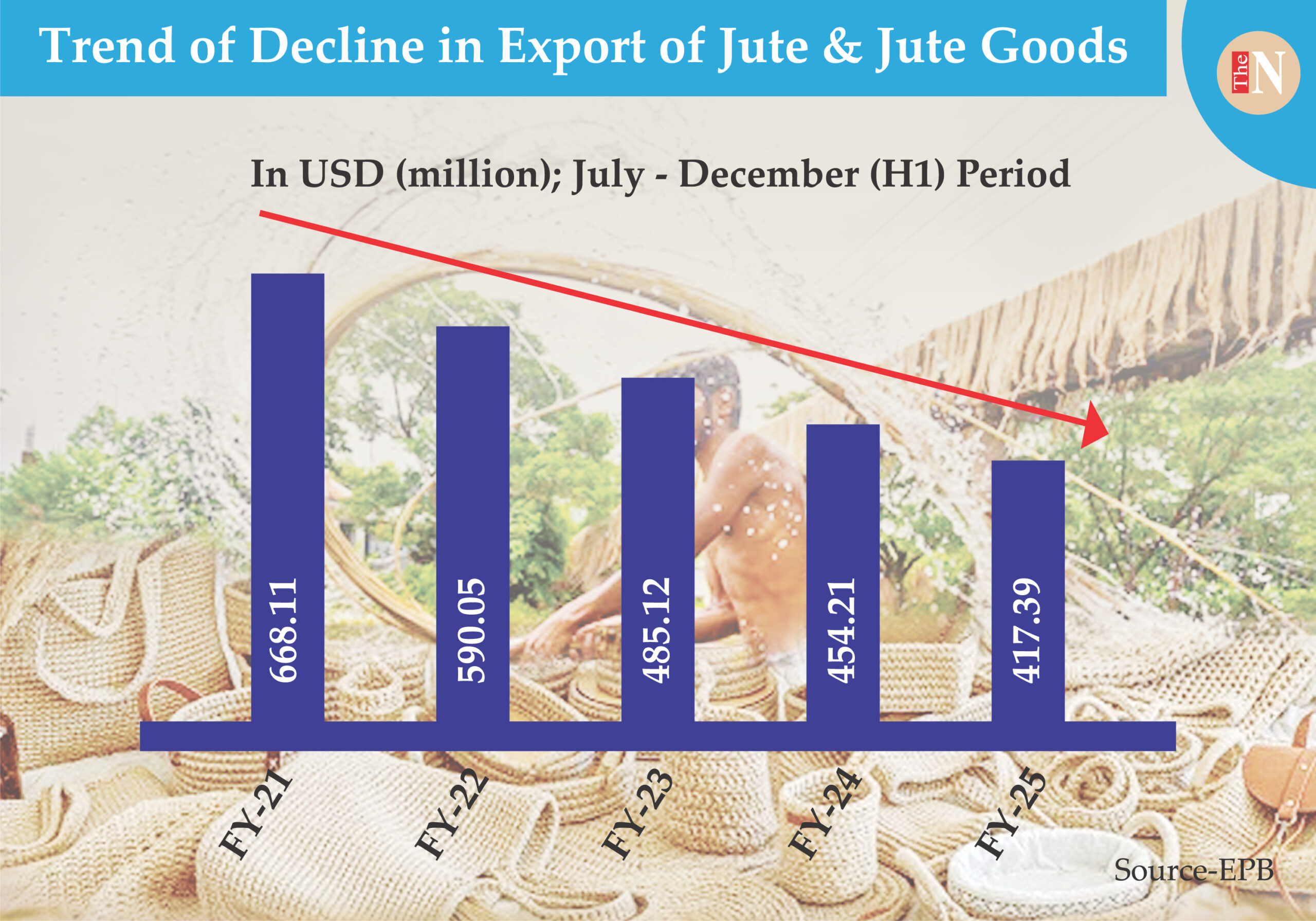

Merchandise exports of jute and jute goods have declined for the fifth consecutive years in the first six months of the current financial year of 2024-25 (H1FY25), raising significant concerns for the promising industry, which is one of the few sectors with locally available raw materials.

Exports from this historically significant sector amounted to only $417.39 million during the July-December period of this fiscal year, reflecting an 8.11 per cent decline compared to the same period in the previous fiscal year, according to the latest Export Promotion Bureau (EPB) data.

In comparison, during the first six months of FY23 and FY22, the country’s jute industry earned $454.21 million and $485.12 million, respectively, as per EPB data.

Experts attribute the decline in jute exports to shrinking global demand, increasing domestic production costs, poor trade diplomacy regarding jute and jute goods, aggressive marketing by rival countries, and the persistent anti-dumping duty imposed by India.

In December 2022, India extended the Anti-Dumping Duty (ADD) on jute products imported from Bangladesh for another five years.

Bangladesh primarily exports raw jute, jute yarn and twine, sacks and bags, and other jute-made products to the global market. Bangladeshi entrepreneurs currently produce 282 types of jute products, which are exported to 135 countries worldwide.

In the first six months of FY25, raw jute exports increased by 6.41 per cent, while exports of jute sacks and bags rose by 5.18 per cent.

However, exports of jute yarn and twine, which constitute a significant portion of Bangladesh’s jute-related international trade, declined alarmingly by 13.20 per cent in H1FY25 compared to the same period of the previous fiscal year.

Jute yarn and twine exports have been on a downward trend since reaching their peak of approximately $800 million in the 2020-21 fiscal year.

Market insiders argue that jute exports are currently facing multiple challenges on both the demand and supply sides. Demand in Europe and other key markets, including Turkey, has consistently declined in recent years in terms of both value and volume, alongside a lack of product diversity.

Exporters are struggling to sustain their position in the global market despite reducing prices, owing to the shrinking global demand.

Abdul Barik Khan, Secretary of the Bangladesh Jute Mills Association, told The New Nation that jute hoarders are driving up raw jute prices, complicating the situation. He also blamed the persistent anti-dumping duty imposed by the Indian government for the poor export performance.

“The anti-dumping policy is a major barrier for us, as India is a significant market for raw jute. The government should negotiate the issue to reclaim the lost glory of this sector,” he urged.

Textiles and Jute Adviser SK Bashir Uddin recently warned against jute hoarders, stating that stern action would be taken against those attempting to create any crisis in the jute sector.

“Some traders are stockpiling jute in an attempt to create an artificial crisis. We will take tough action against them to stabilise the market,” he said.

Holding the ousted Awami League (AL) government responsible for the decline of the jute sector, the adviser stated that the present government is working relentlessly to revive the sector and improve the livelihoods of those employed in it.

Meanwhile, Bangladesh’s export earnings in the first half of the current financial year 2024-25 stood at $24.53 billion, marking a 12.84 per cent increase compared to $21.74 billion in the same period of FY24, driven by the increased shipment of ready-made garment products.