Wage growth falls behind rising inflation rates

Muhid Hasan :

The monthly wage growth for Bangladesh’s working class has remained below the overall inflation rate for the past 34 months, since February 2022. This trend indicates that workers are increasingly cutting back on consumption to cope with rising financial pressures.

Since May 2022, food inflation has consistently outpaced wage growth. In July 2024, food inflation surged to an alarming 14.10 per cent, exceeding average monthly wage growth by 6.17 percentage points – the highest gap in years, according to the Bangladesh Bureau of Statistics (BBS).

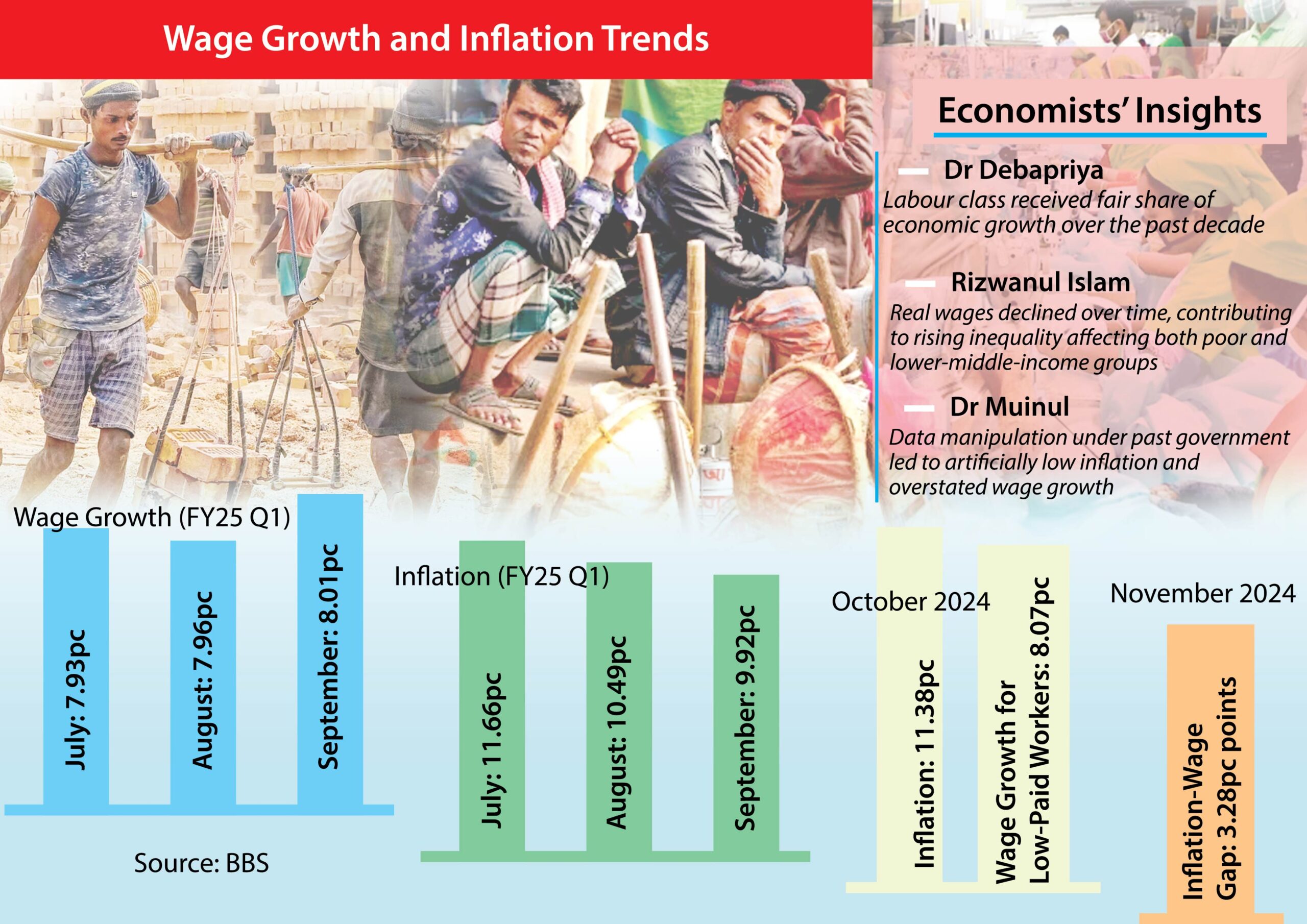

For the first quarter of FY25 (July-September), BBS data showed monthly wage growth rates of 7.93 per cent, 7.96 per cent, and 8.01 per cent. By contrast, inflation during these months stood at 11.66 per cent, 10.49 per cent, and 9.92 per cent, respectively, meaning inflation continues to erode the purchasing power of workers.

In October, inflation hit 11.38 per cent, while wages for low-paid skilled and unskilled labourers grew by only 8.07 per cent, widening the gap between inflation and wage growth to 3.28 percentage points in November. The average monthly wage for low-paid workers, covering 63 occupations in agriculture, industry, and services, is calculated by the BBS.

In FY24, worker wages grew by 7.74 per cent, while the Consumer Price Index (CPI), which measures inflation, rose by 9.73 per cent. Similarly, in FY23, the CPI climbed by 9.02 per cent, while wage growth was just 7.02 per cent. This disparity has led to reduced consumption, particularly among low-income groups, who are now forced to consume less food and lower their standard of living.

A recent study by the Research and Policy Integration for Development (RAPID) found that persistent high inflation since 2022 has pushed an additional 7.9 million people into poverty, increasing the total number of people living below the poverty line to 38.2 million.

Furthermore, RAPID reported that 9.8 million people are at risk of falling into poverty, and 3.8 million individuals who were previously considered poor have now descended into extreme poverty.

MA Razzaque, Chairman of RAPID, stated, “Real wages have not increased at the same rate as poverty has risen. As a result, poverty and vulnerability have increased.” Experts are concerned about the long-term consequences of this wage-inflation gap, which could lead to malnutrition, lack of education, and broader economic injustice, all of which threaten social stability and long-term growth.

Inflation in Bangladesh has remained above 9 per cent for the past 21 months, according to data from the state-run statistical agency.

Alarmingly, overall wage growth has also lagged behind inflation for most of the past decade. Between 2013-14 and 2022-23, the nominal wage rate increased by an average of just 6.26 per cent, while inflation consistently exceeded 7 per cent. During this period, wage growth in agriculture, industry, and services ranged from 5 per cent to 7.01 per cent, while inflation fluctuated between 7 per cent and 9.02 per cent.

Renowned economist Dr Debapriya Bhattacharya, who headed the White Paper Committee on the state of Bangladesh’s economy, stated that the country’s labour class has not received a fair share of the economic gains in recent years. “Whatever development took place in Bangladesh over the last decade, the labour class did not get their fair share,” he commented.

Inflation, according to Bhattacharya, “acts like a tax, affecting everyone, rich and poor alike.” He explained that higher inflation forces poor and middle-class families to struggle to increase their incomes sufficiently to maintain their households.

Rizwanul Islam, an economist and former special adviser for employment at the International Labour Office in Geneva, said the decline in real wages has significantly contributed to rising income inequality in the country. “The real wages of workers have actually declined over time. The distress caused by rising prices is affecting not only the poor, but also lower-middle-income groups,” he highlighted.

Veteran economist Professor Dr Muinul Islam, speaking to The New Nation, expressed concerns over discrepancies between the BBS inflation statistics and the reality on the ground. He suggested that inflation figures were understated, while monthly wage growth figures appeared artificially high due to data manipulation under the current government.

As real incomes continue to fall, Dr Muinul urged the government to implement effective policies to raise wage growth in line with inflation, based on accurate and comprehensive data from all sectors.

However, he praised the government’s recent move to introduce a minimum wage structure for workers in 15 sectors across the country.

The ongoing wage-inflation disparity remains a critical issue for Bangladesh’s working class, with serious implications for poverty, social equity, and economic stability.