NEC approves Tk 2.30 lakh crore ADP for FY26

Special Corespondent :

In a significant fiscal move, the National Economic Council (NEC) on Sunday approved a Tk 2,30,000 crore Annual Development Programme (ADP) for the upcoming fiscal year 2025–26, drawing attention and debate over whether such a large-scale financial decision is appropriate for an interim government.

Presided over by NEC Chairperson and Chief Adviser Dr Muhammad Yunus, the high-level meeting in the NEC conference room at Sher-e-Bangla Nagar finalized the ADP with the largest share of the allocation—Tk 58,973.39 crore—going to the transport and communication sector. The power and energy sector followed with Tk 32,392.26 crore, and the education sector came third, securing Tk 28,557.43 crore.

Out of the total ADP outlay, Tk 144,000 crore will come from domestic sources, while Tk 86,000 crore will be sourced from foreign loans and grants. Including the self-financed portion of Tk 8,599.71 crore from state-owned entities, the overall ADP size stands at Tk 2,38,599.71 crore.

Planning Adviser Dr Wahiduddin Mahmud, while briefing the media, said the FY26 budget aims to restore economic stability, control inflation, and maintain fiscal discipline. He emphasized that the government would not entertain populist or short-term spending tactics that could escalate debt burdens.

However, the approval of a full-year ADP by an interim administration—especially one that came to office after the August 5 uprising and amid a sensitive political transition—has raised eyebrows among governance and policy experts.

Dr Nazneen Ahmed, Senior Research Fellow at the Bangladesh Institute of Development Studies (BIDS), questioned the move, stating, “Traditionally, an interim government is expected to avoid taking major long-term policy decisions. Approving a Tk 2.30 lakh crore ADP, including decisions on mega projects and foreign debt, borders on overreach.”

Dr Iftekharuzzaman, Executive Director of Transparency International Bangladesh (TIB), echoed similar concerns. “While economic continuity is important, such large-scale commitments may tie the hands of the next elected government. Accountability and legitimacy are key in fiscal governance,” he said.

Mr Iftekharuzzaman cautioning that “allocating foreign loans and committing to mega infrastructure development under an unelected interim setup might generate both domestic and international scrutiny.”

Defending the NEC’s move, Dr Mahmud argued that the budget and ADP were necessary to avoid a development vacuum and to maintain ongoing progress. “No new long-term mega projects have been introduced except for the Matarbari Deep Sea Port project, which is already in motion with Japanese financing,” he added.

He admitted, however, that implementation under the current RADP was slower than usual due to extensive reviews and budget tightening measures introduced after the regime change.

The Planning Adviser also reiterated that the government would aim to maintain the budget deficit within 4% of GDP and avoid excessive dependence on debt, either domestic or external.

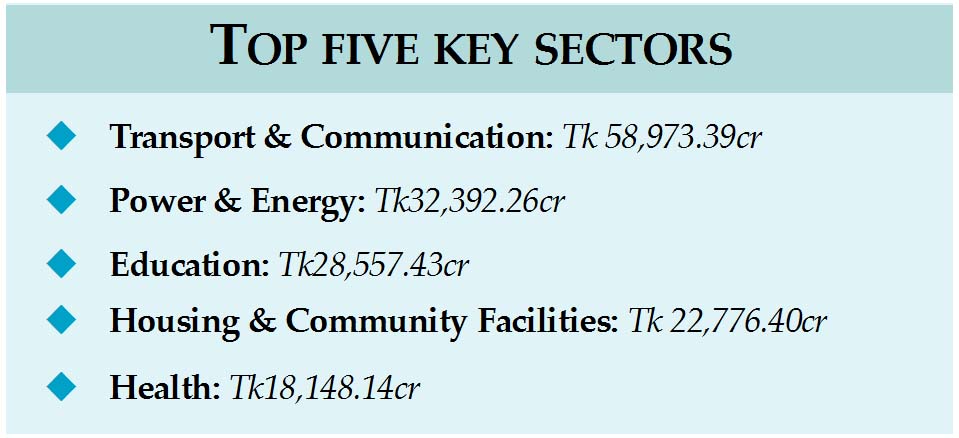

The ADP prioritizes five key sectors, which together account for 70% of the total allocation:

* Transport & Communication:Tk 58,973.39 crore

* Power & Energy:Tk 32,392.26 crore

* Education:Tk 28,557.43 crore

* Housing & Community Facilities:Tk 22,776.40 crore

* Health: Tk 18,148.14 crore

Among ministries and divisions, the Local Government Division received the highest allocation at Tk 36,099 crore, followed by the Road Transport and Highways Division with Tk 32,329.57 crore.

The ADP includes 1,171 projects—993 investment projects, 19 feasibility studies, 99 technical assistance projects, and 60 self-financed projects. Notably, 79 projects are slated for implementation through the Public-Private Partnership (PPP) initiative, and 228 are under the Bangladesh Climate Change Trust Fund.

Experts suggest that while economic momentum is necessary, the legitimacy of making such far-reaching decisions should ideally rest with an elected government. As Finance Adviser Dr Salehuddin Ahmed prepares to unveil the full FY26 budget on June 2, calls for fiscal prudence and institutional transparency are growing louder.