Interim budget targets stability with Tk790,000cr outlay

Staff Reporter :

The interim government is preparing to present a Tk790,000 crore national budget for the 2025-26 fiscal year on 2 June, marking a crucial moment for Bangladesh as it navigates mounting economic pressures and strives for fiscal stability and inclusive growth.

This will be the first budget delivered by the newly appointed administration, which faces the significant task of reining in inflation, reviving private sector investment, and strengthening social safety nets amid a backdrop of global uncertainty and domestic economic strains.

Finance Adviser Salehuddin Ahmed is scheduled to deliver the budget speech through a pre-recorded broadcast at 4pm on Bangladesh Television (BTV) and Bangladesh Betar. All private television and radio stations have been instructed to relay the broadcast using BTV’s official feed.

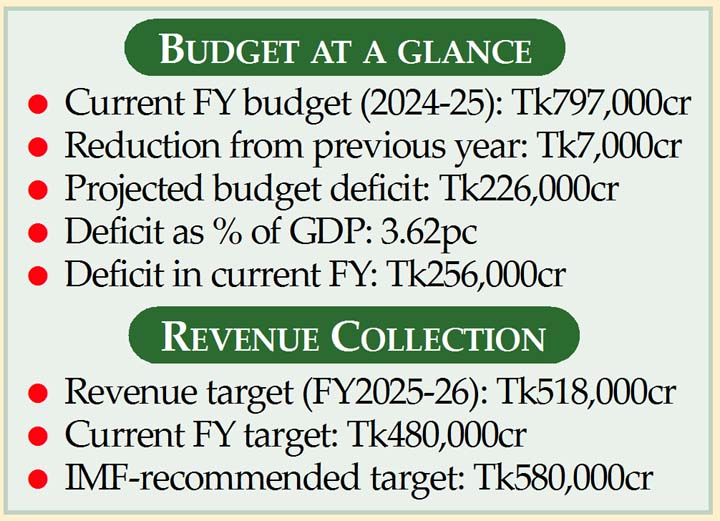

The proposed budget is Tk7,000 crore smaller than the

current fiscal year’s Tk797,000 crore allocation. According to finance ministry officials, the reduction reflects a deliberate move towards fiscal consolidation and a more realistic, actionable financial plan.

The projected budget deficit stands at Tk226,000 crore, representing 3.62 per cent of the Gross Domestic Product (GDP), down from Tk256,000 crore in the ongoing fiscal year. The deficit will be financed through a combination of foreign loans, domestic bank borrowing, and the sale of national savings instruments.

The government has set a GDP growth target of 5.5 per cent for FY2025-26, slightly higher than the revised 5.25 per cent for the current year. However, global financial institutions including the World Bank, International Monetary Fund (IMF), and Asian Development Bank (ADB) forecast growth to remain below 5 per cent, citing ongoing structural weaknesses and external vulnerabilities.

One of the budget’s primary objectives is to curb inflation and bring it down to 7 per cent. Yet, economists warn that sustained price pressures could hinder this goal unless effective measures are taken.

To ease the impact on low-income households, the budget will expand the coverage and size of social safety net programmes. Additional funds will be allocated to key sectors such as agriculture, healthcare, education, and information technology.

The Annual Development Programme (ADP) has been allocated Tk230,000 crore-reduced from Tk265,000 crore in the current fiscal year-in line with a strategy to focus on more targeted and efficient public investments.

Finance Adviser Salehuddin Ahmed has signalled that the budget will be investment-oriented, with tax reforms intended to drive GDP growth, employment, and business activity.

The revenue collection target for FY2025-26 is set at Tk518,000 crore, an increase from Tk480,000 crore in the current year. However, under IMF reform conditions, the government is being urged to raise the target further to Tk580,000 crore to ensure greater fiscal discipline.

Non-development expenditure is expected to rise to Tk560,000 crore, up by Tk28,000 crore from the current fiscal year. A substantial portion of this will be allocated for debt servicing, food subsidies, and banking sector reforms.

The government also plans to inject funds into state-owned banks to address capital shortfalls, alongside continued subsidies for agriculture, fertilisers, and electricity-considered essential for maintaining food security and power supply.

Public expectations surrounding the upcoming budget are mixed. While many welcome the promised expansion of social protection schemes and efforts to control inflation, there is growing scepticism about the feasibility of the ambitious targets.

Economists argue that effective implementation and deeper structural reforms-particularly in tax administration-are essential for long-term fiscal sustainability. They have called for an expansion of direct taxation, including wealth taxes, and stronger enforcement to reduce the government’s reliance on regressive indirect taxes.

The budget announcement is set against a backdrop of political transition, and Finance Adviser Salehuddin Ahmed’s address is expected to receive close scrutiny. Observers see it as a potential turning point in Bangladesh’s economic trajectory-one that could either reinforce or challenge public confidence in the new administration’s ability to deliver results.