Inflation eases but wage growth still below CPI

Muhid Hasan :

Bangladesh’s point-to-point inflation rate eased to 8.48 per cent in June, down from 9.05 per cent in May, reaching its lowest level in more than two years, according to data released by the Bangladesh Bureau of Statistics (BBS) on Monday.

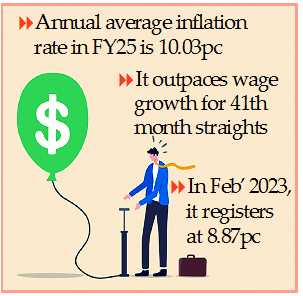

This marks the first time in 27 months that inflation has fallen below the 9 per cent threshold. The last occasion inflation stood lower than this was in February 2023, when it registered at 8.87 per cent.

BBS attributed the June decline to falling food and non-food prices across both urban and rural areas. Food inflation decreased sharply to 7.39 per cent from 8.59 per cent in May, offering some relief to households grappling with high living costs. Meanwhile, non-food inflation dipped marginally to 9.37 per cent, down from 9.42 per cent the previous month.

Despite the easing in recent months, the average inflation for the fiscal year 2024-25 (July-June) stood at 10.03 per cent. In comparison, the rate was 9.73 per cent in FY2023-24 and 9.02 per cent in FY2022-23.

Since February 2023, inflation had consistently remained above 9 per cent, peaking at 11.66 per cent in July 2024 – amid a period of mass protests. The rate began declining in January 2025, when it dropped to 9.94 per cent, followed by further reductions in February (9.32 per cent), April, May, and now June, interrupted only by a brief uptick in March.

Press Secretary to the Chief Adviser, Shafiqul Alam, stated on Monday that the downward trend in inflation reflects the effectiveness of the interim government’s policy decisions. In a post from his verified Facebook account, he expressed optimism that inflation would continue to fall in the coming months.

The interim government assumed office following the ousting of the previous Awami League administration on 5 August 2024, in the wake of a mass uprising led by students. Shortly after taking charge, Chief Adviser Muhammad Yunus introduced a series of anti-inflation measures.

Key among these has been a tightening of monetary policy, including several interest rate hikes intended to reduce excess liquidity and curb domestic demand. Government data for the past five months indicates these actions have had a cooling effect on inflation.

However, market-level impact remains limited, with prices of essential goods continuing to pose challenges for consumers.

Bangladesh Bank Governor Dr Ahsan H Mansur, speaking on 3 July, expressed confidence that inflation is now within a manageable range and projected further easing in the coming months. He credited the government’s coordinated monetary efforts for this progress.

The government has set an ambitious target of reducing inflation to 6.5 per cent by the end of the current fiscal year (FY2025-26).

Despite the downward inflation trend, wage growth has failed to keep pace. For the 41st consecutive month since February 2022, monthly wage growth remained below the overall inflation rate. In June 2025, wage growth declined to 8.18 per cent-falling short of the Consumer Price Index (CPI) for the month – signalling persistent financial pressure on working-class households.