Indian port curbs add new pressure to jute sector

Farrukh Khosru :

The Bangladeshi jute sector is under renewed strain following India’s latest restrictions on the import of jute products-a move many experts and industry representatives have described as protectionist and detrimental to regional trade.

On 11 August 2025, India’s Directorate General of Foreign Trade (DGFT) issued an order limiting the import of various jute goods from Bangladesh through land ports along the India-Bangladesh border. Under the new directive, only the NhavaSheva seaport in Maharashtra remains open for such imports.

The restricted items include bleached and unbleached woven jute fabrics, twine, cordage, ropes, and jute sacks and bags – products in which Bangladesh has long maintained global leadership, according to a report published in The Hindu on Thursday.

Indian officials have defended the move, claiming that export subsidies from Bangladesh are adversely impacting local Indian industries. They have also accused Bangladeshi exporters of mislabelling goods to circumvent existing anti-dumping duties. However, analysts argue that the measures unfairly target a key Bangladeshi sector that has historically supported employment, economic development, and sustainable production.

Bangladeshi jute manufacturers have expressed concern that the restrictions will harm not only exporters but also the thousands of farmers and workers who depend on the jute trade for their livelihoods. “The Indian restrictions are a barrier to free trade and undermine decades of cooperation between our countries,” said a senior industry representative in Dhaka.

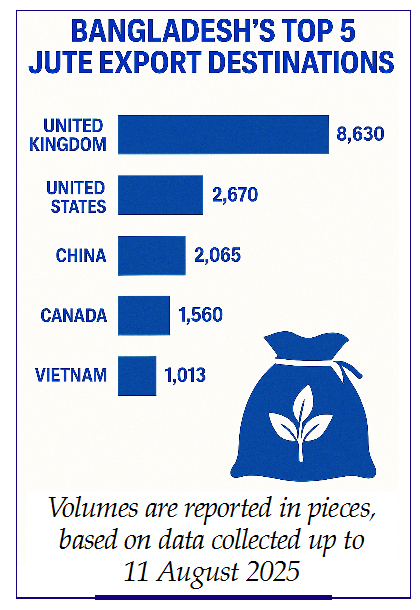

Until 11 August 2025, according to Volza’s export data, Bangladesh primarily exported jute to the United States, United Kingdom, China, Canada, Vietnam, and Kazakhstan. In 2023 alone, Bangladesh exported $412 million worth of jute yarn, making it the world’s largest exporter of jute yarn (out of 85 countries). That year, jute yarn ranked as Bangladesh’s 24th most exported product (out of 945).

In 2023, the principal destinations for Bangladesh’s jute yarn exports included Turkey, China, India, Uzbekistan, and Côte d’Ivoire. The fastest-growing markets between 2022 and 2023 were Uzbekistan (up by $7.22 million), India (up by $2.81 million), and Ukraine (up by $518,000). Notably, in 2023, India was a major importer of jute and other textile fibres from Bangladesh, with total imports valued at $93.6 million. Among the top exporters of jute, India led with 190,334 shipments, followed by China and Sri Lanka.

However, the latest Indian restrictions have significantly disrupted land-based trade routes, compelling Bangladeshi exporters to reroute shipments via the NhavaSheva seaport in Mumbai. This follows India’s imposition of anti-dumping duties on Bangladeshi jute products in 2017, which had already negatively impacted the sector.

These recent actions come on the heels of earlier Indian restrictions on ready-made garments and certain food items, further intensifying economic pressure on Bangladesh. Observers have noted that such measures are occurring at a time when Bangladesh is actively working to enhance regional connectivity and trade, especially with its landlocked neighbours in northeastern India and beyond.

During a recent visit to China, Bangladesh’s Chief Advisor, MuhammedYunus, promoted the country as a gateway for trade with northeastern India, Nepal, and Bhutan-highlighting its growing strategic importance in the region. However, these remarks drew criticism from Indian political leaders, exacerbating tensions in bilateral trade relations.

Industry experts stress that instead of imposing restrictive measures, India and Bangladesh should pursue greater collaboration to facilitate cross-border trade. Such cooperation, they argue, would deliver mutual economic and social benefits. Bangladesh’s jute sector-already globally recognised for its quality and sustainability-deserves equitable access to Indian markets, rather than facing unilateral barriers.

As the dispute escalates, stakeholders are urging both nations to engage in dialogue and adopt mutually beneficial policies to avoid further disruption to one of the region’s most historic and vital industries.