Import growth picks up pace on strong export, remittance flows

Muhid Hasan :

A strong inflow of remittances and increased export earnings has led to a rise in Bangladesh’s overall imports during the first eight months (July-February) of the current financial year 2024-25.

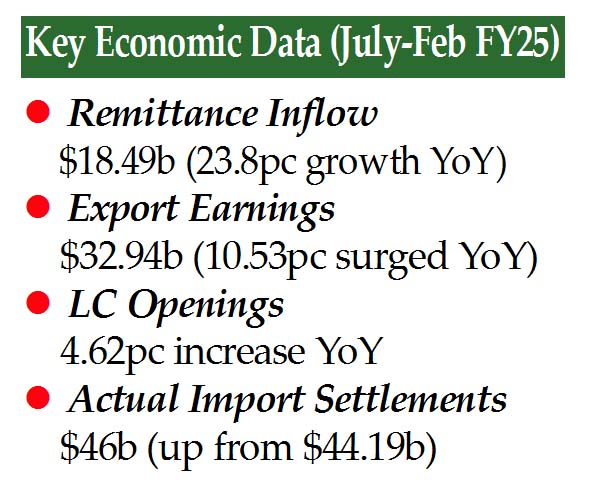

According to provisional data from Bangladesh Bank (BB), total remittance inflows reached $18.49 billion during this period, reflecting a 23.8 per cent increase from $14.94 billion recorded in the same period of the previous fiscal year.

Similarly, export earnings grew by 10.53 per cent, reaching $32.94 billion in the first eight months of FY25, compared to $29.80 billion during the same period last year, as reported by the Export Promotion Bureau (EPB).

The increase in both remittances and export earnings has boosted the availability of US dollars in the banking sector, contributing to a significant rise in the opening and settlement of import letters of credit (LCs).

Bangladesh Bank’s latest data indicates that LC openings increased by 4.62 per cent year-on-year from July to February of FY25. During the same period, LC settlements rose to $46 billion, up from $44.19 billion in the previous financial year. In February 2025, LC settlements amounted to $5.74 billion, reflecting a 20.59 per cent increase compared to $4.76 billion in February of the previous year.

Earlier, during July-December (H1FY25), actual LC settlements increased by 2.65 per cent, reaching $34.32 billion, up from $33.44 billion in the same period of the previous fiscal year.

This growth indicates a gradual recovery in business activity following a period of stagnation in July and August, despite ongoing economic uncertainties.

Experts attribute the increase in remittances to reduced money laundering and a shift from informal to formal channels.

Additionally, the realization of export proceeds has accelerated under changing economic conditions.Usually, Bangladesh aims to maintain average monthly imports between $5.5 billion and $6 billion to sustain economic growth.

Since April 2022, the Bangladesh Bank and the government introduced several measures to curb rapid import growth and protect foreign exchange reserves, including high LC margins on non-essential and luxury items.

While these restrictions led to a decline in LC openings from 2023, they have recently been relaxed.

As of 20 February 2025, gross foreign exchange reserves stood at $21 billion, significantly lower than $46 billion in December 2021, in line with International Monetary Fund (IMF) guidelines.

Eminent economist and academic Muinul Islam told The New Nation that the Anti-discrimination Student Movement in July and August directly affected imports.

However, from September onwards, LC openings showed an upward trend, with import payments reflecting a return to normal economic activity.

He emphasised that rising remittances and export earnings are helping to stabilise the economy despite high bank interest rates and low private sector credit growth.

Muinul Islam also recommended that policymakers take effective measures to increase imports of capital machinery and intermediate goods to boost employment and production in the future.

The current fiscal year has seen a 25 per cent decline in LC payments for capital machinery and an 8.5 per cent drop for intermediate goods, indicating ongoing challenges in these sectors.