Foreign loan flow declines in 8 months of FY25

Muhid Hasan :

Foreign loan commitments and disbursements to Bangladesh have significantly declined during the first eight months of the 2024-25 fiscal year, primarily due to policy shifts and implementation challenges, while repayments of foreign loans have seen a notable increase.

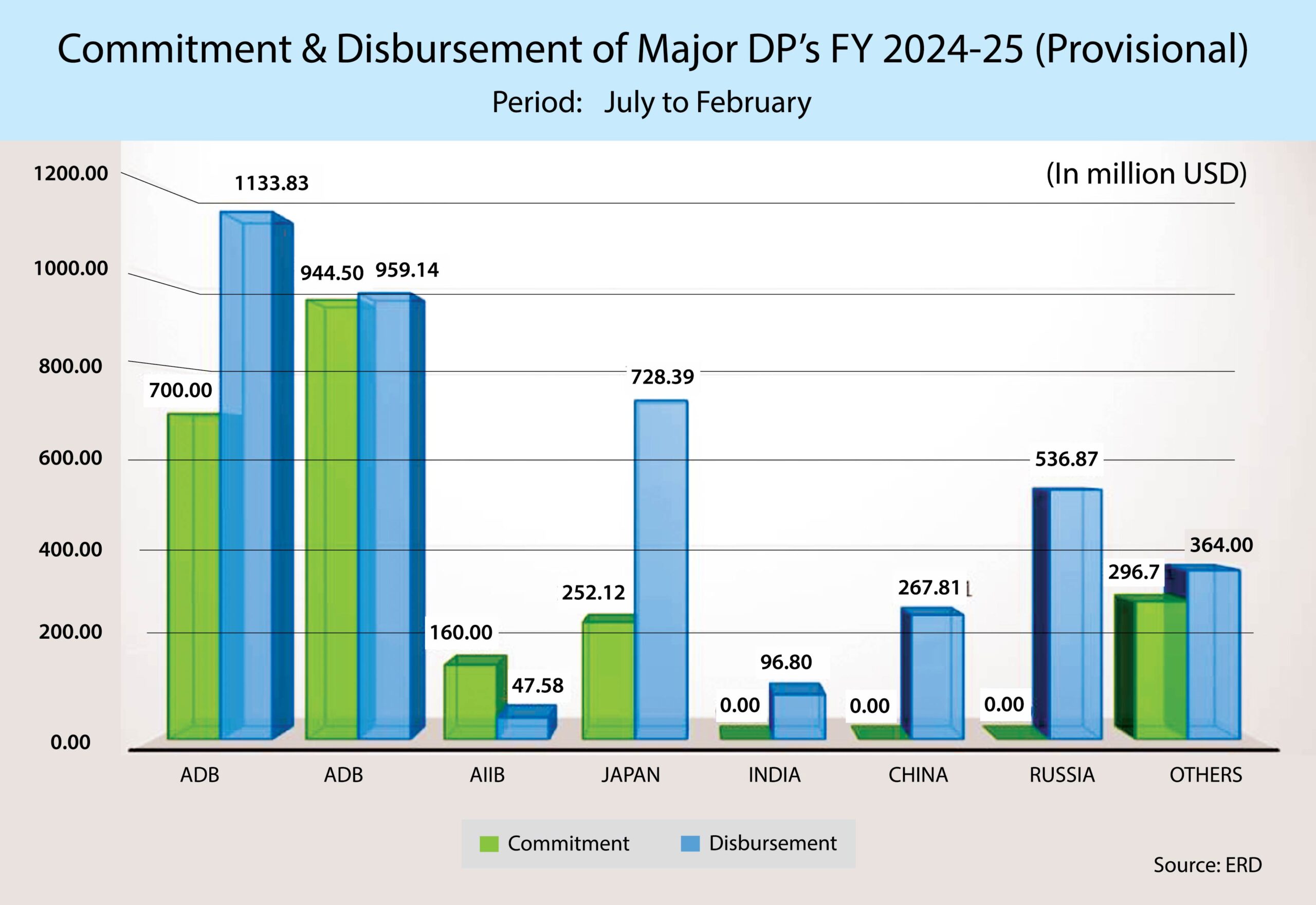

Data from the Economic Relations Division (ERD), published on Monday, reveals that fresh loan commitments dropped by 67.3 per cent year-on-year between July and February, and disbursements decreased by 17.3 per cent in the ongoing financial year.

In the first eight months of the current fiscal, commitments from multilateral and bilateral lenders totalled $2.35 billion, a sharp decline from $7.20 billion during the same period last year.

Correspondingly, foreign loan disbursements amounted to $4.13 billion, down from $4.99 billion in the previous year, reflecting a reduction of $860 million.

In contrast, the government made significant repayments on foreign debt, paying $2.64 billion compared to $2.03 billion during the same period last year.

The government received the highest commitment of $944.5 million from the World Bank in July-February, followed by $700 million from the Asian Development Bank, $252 million from Japan, and $160 million from the Asian Infrastructure Investment Bank, according to ERD data, However, key lenders such as India, China, and Russia did not make any new commitments during this time.

Analysts said that slow project implementation has played a role in the decline of new foreign loan commitments.

They identified the July-August turnaround significantly reduced foreign commitments as the government has become cautious about new projects.

ERD officials further indicated that several projects initiated under the previous Awami League government have been scrapped, contributing to the reduction in commitments.

In an effort to alleviate debt repayment pressures, the government is focusing on securing debt relief and reducing new commitments.

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told The New Nation that the previous government took substantial foreign loans for large-scale projects, while the current government is concentrating on debt relief and reassessing the borrowing strategy.

He also noted that sluggish project implementation, especially in the first quarter of FY25, has contributed to the reduced disbursements of foreign loans.

Dr Hussain expressed hope that if the government successfully concludes its reform initiatives, foreign development partners may once again offer their financial support.

Meanwhile, the revised budget for FY25 includes a projected foreign loan component of Tk81,000 crore. However, given the declining trend in foreign loan inflows, it remains uncertain whether this target will be achieved.