Staff Reporter :

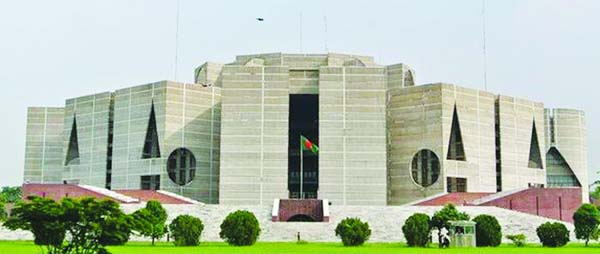

The Finance Bill for the fiscal year 2024-25 was passed in Parliament on Saturday, offering an amnesty to legalize undisclosed income by paying a 15 percent tax.

Taxpayers, including companies and firms with black money, now have the opportunity to legalize their undeclared wealth without facing any questions about the sources of their income in the next fiscal year.

According to the provision, no authority can raise any question if any taxpayer, including companies, pays a 15 percent tax on cash, bank deposits, financial securities, or any other forms of wealth.

Additionally, they will have to pay a specific tax on properties—land, buildings, flats, or commercial spaces—to whiten their wealth, according to the new tax law.

Furthermore, the maximum individual income tax rate remains unchanged at 25 percent, instead of the proposed 30 percent for the next fiscal year.

In his budget speech, Finance Minister Abul Hasan Mahmood Ali had proposed increasing the individual tax rate from 25 percent to 30 percent for the highest income earners.

Income from the universal pension scheme or any amount paid into the scheme has been exempted from tax.

On the other hand, companies, funds, and trusts will have to pay a 15 percent tax on earned capital gains, according to the new tax guidelines. In the previous budget proposal, this provision only applied to individuals.

People who own multiple cars will have to pay an environmental surcharge, and amendments to the bill ensure that this provision will not apply to any government institutions or companies.

Any taxpayer showing their income increased by 15 percent from the previous year’s income tax returns will not have to face an audit, according to the new guidelines.

Additionally, an income tax return deposit slip has been made mandatory to rent any community centers or convention halls under the city corporations.

Under the previous budget proposal, the provision applied to the rental of all community centers or convention halls.