Staff Reporter :

The aspiration of home ownership for the middle class is becoming increasingly unattainable due to the exorbitant prices of key construction materials, rising registration fees, and heightened import duties and taxes imposed by the government.

In recent years, the cost of housing has surged beyond the reach of middle-income earners.

The prices of essential construction materials have skyrocketed, while government policies have further exacerbated the situation by increasing import duties and taxes.

These factors have significantly dimmed the prospects of home ownership for this demographic.

The affordability of housing has deteriorated sharply, particularly following the pandemic.

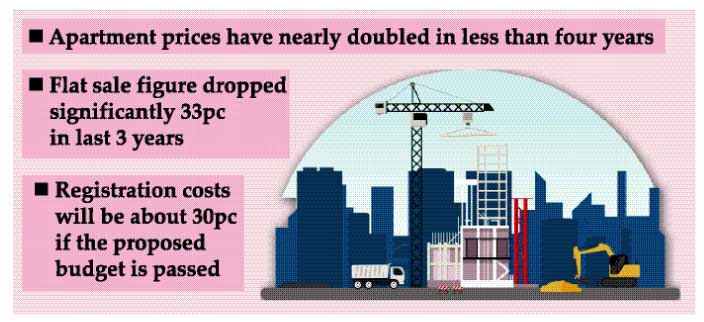

Apartment prices have nearly doubled in less than four years. Data from the Real Estate & Housing Association of Bangladesh (REHAB) indicates that the prices of locally sourced building materials, such as sand, have more than doubled between 2021 and 2023. The price of local sand per cubic foot rose from Tk 15 in 2021 to Tk 35 last year.

Similarly, the cost of Thai aluminium frames for windows and doors has seen a substantial increase, climbing from Tk 280 per square foot in 2021 to Tk 480 by the end of last year. These price hikes have put a severe strain on the housing sector.

Adding to the financial burden, taxation and registration fee increases have further strained the housing market. In the current financial year, buyers must pay 22 percent of the land or flat purchase price as a registration fee. This significant expense is a major deterrent for prospective homeowners.

Moreover, the proposed budget for the fiscal year 2024-25 includes further increases in taxes and duties across various sectors. This will inevitably push construction costs for houses and flats even higher, making affordable housing increasingly elusive for the middle class.

Data from the Real Estate & Housing Association of Bangladesh (REHAB) reveal a sharp decline in flat sales.

REHAB members sold approximately 15,000 flats in each of the fiscal years (FY) 2020-21 and 2021-22. However, this figure dropped significantly to around 10,000 in FY 2023.

Regarding the proposed increase in the registration fee for the fiscal year 2024-25, REHAB President Md Wahiduzzaman expressed concerns.

“We request a change in the method of revenue collection from the real estate sector. Registration costs will be about 30 percent if the proposed budget is passed. This amount of registration cost doesn’t exist anywhere else in the world,” he stated.

Wahiduzzaman suggested that the government introduce a 4 percent registration fee for five-year-old flats in the secondary market to make housing more affordable for low-income families.

Additionally, REHAB, which had around 1,200 members several years ago, has seen a decline to 841 members recently. This drop indicates that some companies have suspended their operations.

Despite these challenges, the real estate sector continues to play a significant role in the economy, contributing approximately 8 percent to the gross domestic product (GDP), according to data from the Bangladesh Bureau of Statistics.