Despite commitment, disbursement fall: Debt servicing for foreign loans surges

Staff Reporter :

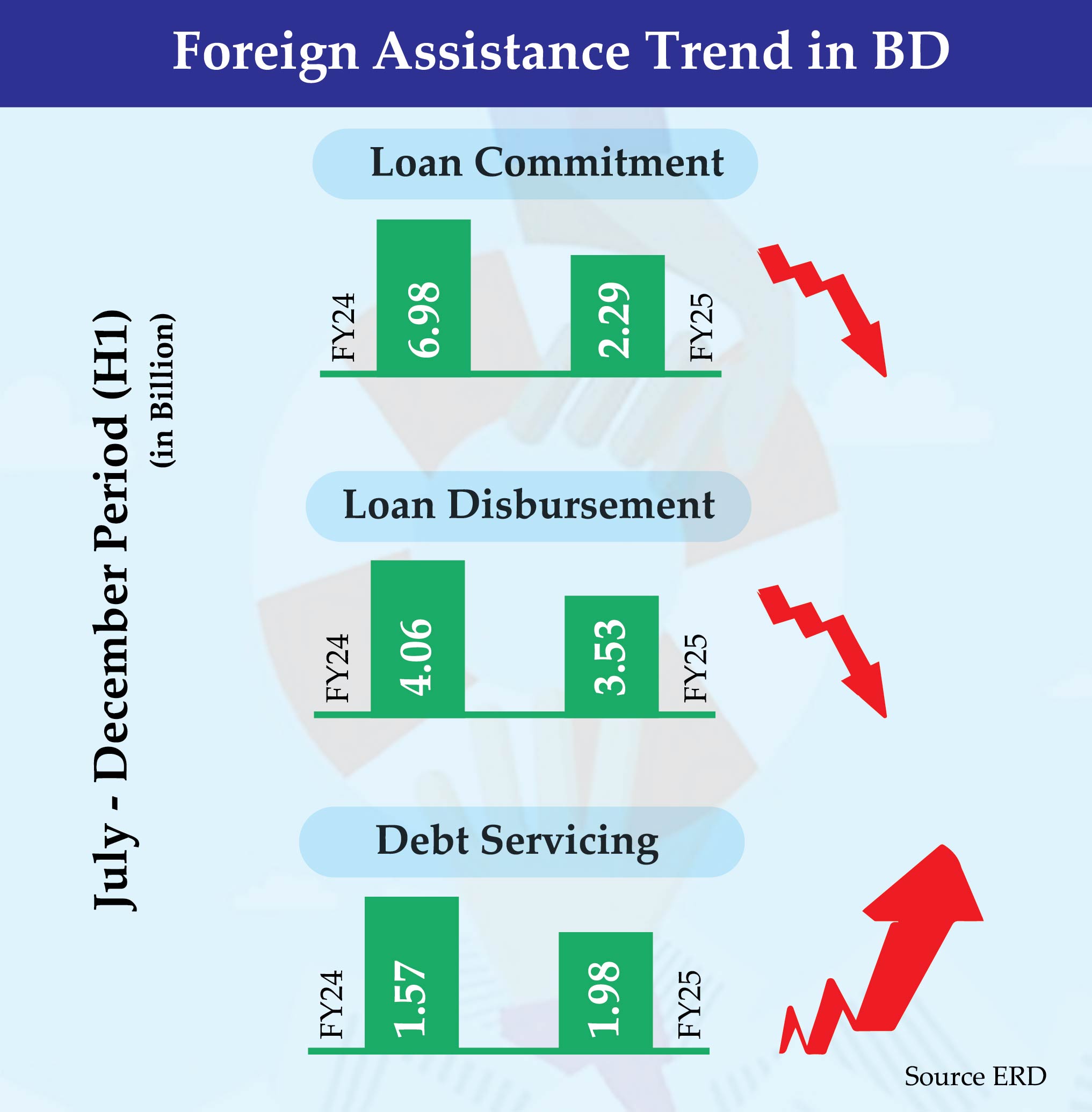

Bangladesh’s foreign debt servicing surged by 27 per cent in the first half (H1) of the current financial year 2024-25, driven by escalating interest payments.

During the July-December period of FY25, the country repaid $1.98 billion, comprising $747.56 million in interest payments and $1.23 billion in principal repayments, according to data released by the Economic Relations Division (ERD) on Sunday.

In comparison, during H1FY24, Bangladesh repaid a total of $1.567 billion, which included $926 million in principal repayments and $641 million in interest payments.

The ERD data also revealed that loan repayments in local currency increased to Tk 23,675 crore in H1FY25, up from Tk 17,240 crore in the corresponding period of the previous year, further straining public finances.

Meanwhile, foreign loan commitments from development partners to Bangladesh plummeted by 67.11 per cent year-on-year in the first half of FY25, despite the country securing $1.1 billion in budget support from the World Bank and the Asian Development Bank.

Bangladesh received only $2.298 billion in loan commitments during the period, compared to $6.989 billion in the same period of the previous fiscal year.

Similarly, the disbursement of loans also declined by 13 per cent in H1FY25, with development partners disbursing $3.532 billion-primarily for project assistance-compared to $4.06 billion in the previous year.

Economists and experts have raised concerns over the increasing debt servicing burden on public finances amid declining loan disbursements and commitments.

The government’s expenditure on interest payments for servicing its growing debt has significantly increased in the current budget, accounting for 14.5 per cent of the FY25 budget.

ERD officials stated that the new government is reviewing proposed projects for foreign loans, leading to a decrease in commitments as new loan agreements are not being signed.

Furthermore, the implementation of foreign-financed projects is proceeding cautiously, with pipeline projects undergoing re-evaluation and loan processing prioritised based on their importance.

Earlier, ERD officials informed the media that Bangladesh will need to pay over $4.5 billion in debt servicing in FY25. In FY26, foreign debt principal and interest payments are projected to approach $5 billion, with interest payments estimated at approximately $1.7 billion and principal repayments at $3.3 billion.

Debt servicing is expected to peak in FY27, when Bangladesh’s foreign debt servicing, including both principal and interest, is projected to reach a historic high of $5.3 billion, according to ERD officials.