Special Correspondent :

Bangladesh is currently under mounting pressure to meet its foreign debt interest obligations amid a severe economic crisis.

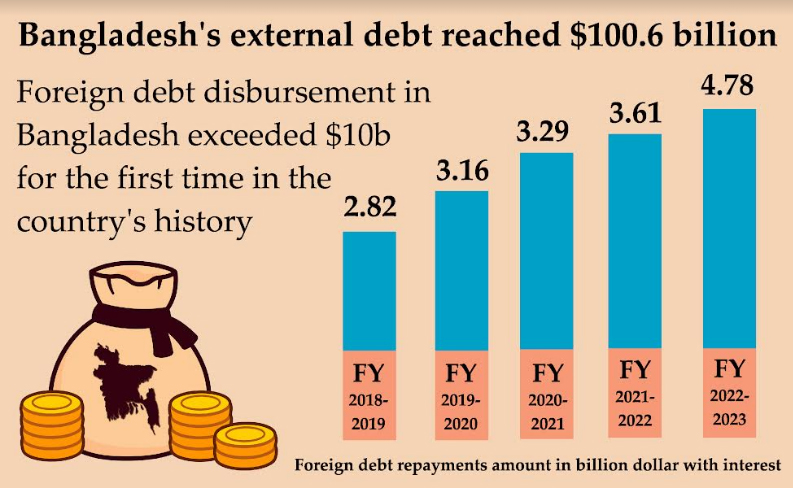

The increasing external debt servicing obligations are putting additional strain on the country’s already low foreign exchange reserves. As of December 2023, Bangladesh’s external debt reached $100.6 billion.

In the fiscal year 2021-22, foreign debt disbursement in Bangladesh exceeded $10 billion for the first time in the country’s history.

However, due to weaknesses in the implementation of development projects over the past two fiscal years, organisations are struggling to release the foreign debt.

In the first 11 months of the current fiscal year, Bangladesh has managed to disburse only seven billion dollars. With just one month remaining, disbursing the total eight billion dollars is now a significant concern.

According to the latest data released by the Economic Relations Division (ERD), interest payments alone have increased by 42 percent. Additionally, approximately 44 percent of the loans received in this financial year were used to repay previous loans.

In the 11 months of the current financial year, a total of 702 crore dollars have been disbursed. Of this amount, 661.53 crore dollars were loans, and the remaining 40.51 crore dollars were received as grants. During this period, 43.70 percent of the previous loan amount had to be repaid.

According to the Economic Relations Division (ERD), loan repayments in Bangladesh have surged by 24.36 percent this year compared to the previous year.

In the first 11 months of the current financial year, the government paid $3.0681 billion in foreign loan repayments, up from $2.4671 billion in the same period last year highlighting the growing pressure on the nation’s foreign debt interest payments amidst Bangladesh’s ongoing economic crisis.

Within a year, the interest rate on foreign debt alone has increased by more than 42 percent. Additionally, Bangladesh’s foreign loan commitments have risen significantly. This year, the government received $7.9276 billion in foreign loan commitments, compared to $5.9746 billion last year.

To secure a $4.5 billion loan from the International Monetary Fund (IMF), Bangladesh has had to accept various conditions, including the implementation of institutional reforms. These conditions are adding challenges to the country’s economy.

The value of the dollar has surged by seven taka in just one day, leading to a 6.36 percent depreciation of the taka against the dollar. This devaluation will exacerbate the pressure on foreign debt repayments and compounding the issue the country’s foreign exchange reserves have dropped to $18 billion, according to experts.

“There is indeed a foreign exchange crisis at this moment. However, steps have been taken to address this situation. Measures to reduce costs include limiting the import of luxury goods and restricting pleasure trips abroad,” Fayaz Alom, Deputy Managing Director of Janata Bank, told The New Nation on Thursday in response to a question regarding the dollar crisis.

Regarding foreign remittances, Alom noted, “Compared to the first five months of last year, foreign remittances have increased by more than $1.5 billion. We expect this trend to continue. Considering the overall scenario, we are optimistic about overcoming this crisis.”

Economists note that a significant portion of Bangladesh’s development expenditure is financed through foreign loans. Consequently, the government’s expenditure on interest and principal repayments of these loans is gradually increasing.

With the appreciation of the dollar, interest rates are expected to rise, exacerbating the financial strain. In response, the government is attempting to increase the supply of dollars to manage additional spending and mitigate the ongoing crisis.

According to the Centre for Policy Dialogue (CPD), Bangladesh’s external debt has surpassed the USD 100 billion mark, reaching USD 100.34 billion. The country’s external debt stock has been rising rapidly in recent years. From FY 2011 to FY 2023, total external outstanding Public and Publicly Guaranteed (PPG) debt has tripled, while debt servicing costs have increased by 2.6 times over the same period.

In September 2023, PPG debt stood at USD 79.0 billion out of a total debt of USD 100.3 billion, indicating a significant rise in this indicator, as noted in a CPD research report. For the fiscal year 2023-24, Bangladesh is expected to borrow USD 10.0 billion from various sources. Between July and February of FY 2023-24, Bangladesh incurred loans amounting to USD 7.2 billion. The external debt stock is anticipated to grow further in the coming years.

According to the International Monetary Fund (IMF), Bangladesh’s foreign exchange reserves stood at USD 19.45 billion as of March 27, 2024. The servicing of public debt, including both interest and principal repayments is accelerating as the grace periods for some of the larger and more stringent loans come to an end. This rate of increase has outpaced GDP growth in recent times, resulting in a rising share of PPG debt in GDP.

From FY 2018-19 to FY 2022-23, GDP in USD terms grew by 35.3 percent, whereas outstanding PPG borrowings and debt servicing grew by 62.8percent and 69.3percent, respectively.