BD lags global mkts as DSEX slumps 3.2pc in sept

Muhammad Ayub Ali :

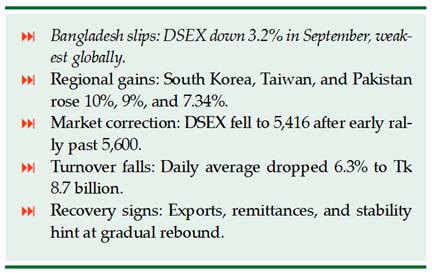

Bangladesh’s stock market was the weakest performer globally in September, with the benchmark DSEX index dropping 3.2Percent amid profit-taking and investor caution after three consecutive months of gains.

In contrast, South Korea led the world’s stock markets with a 10 percent return, followed by Taiwan (9percent) and Pakistan (7.34percent).

According to EBL Securities, only the Philippines which slipped 0.3percent, all major Asian markets posted positive gains during the month.

At the start of September, the DSEX crossed 5,600 points for the first time in 11 months, but selling pressure soon reversed the rally.

By the month’s end, the DSEX had fallen 179 points to 5,416, while the blue-chip DS30 and Shariah-based DSES dropped to 2,082 and 1,172 respectively.

EBL Securities noted that investors have turned cautious due to the lack of fresh market triggers, regulatory tightening, and the approach of the earnings season.

This uncertainty led many to adopt a wait-and-see strategy, contributing to a 6.3percent drop in average daily turnover to Tk 8.7 billion.

Although a few selective stocks attracted “targeted buying,” overall market sentiment remained subdued.

Despite the weak market performance, Bangladesh’s broader economic indicators show signs of gradual recovery.

Rising exports, steady remittance inflows, and a stabilizing foreign exchange situation have supported economic resilience amid global and domestic challenges. Remittances reached $2.7 billion in September — up 11.7percent year-on-year.

Recent trade developments, including a tariff-subsidized agreement with the United States, are expected to sustain export momentum.

Additionally, the announcement of the national election roadmap has somewhat eased political uncertainty, potentially improving investor confidence.

International agencies forecast Bangladesh’s GDP growth at around 5percent for FY2025-26, signaling a slow but steady rebound in economic activity.

However, analysts caution that several headwinds persist. Political tensions ahead of the election, vulnerabilities in the banking sector and sluggish private investment continue to weigh on market confidence.

EBL Securities suggested that a potential reduction in policy interest rates and lower yields on government securities could help revive market sentiment in the coming months.