Monetary policy for H1FY26: BB holds rates steady to rein in inflation

Muhid Hasan :

Bangladesh Bank (BB) on Thursday unveiled its Monetary Policy Statement (MPS) for the first half of the 2025-26 fiscal year, reaffirming a contractionary stance to curb inflationary pressures and preserve financial stability.

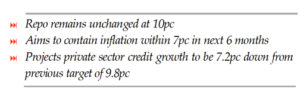

The central bank announced that the policy interest rate (repo rate) will remain unchanged at 10.0 per cent, with the Standing Lending Facility (SLF) and Standing Deposit Facility (SDF) rates held at 11.5 per cent and 8.0 per cent respectively. At the same time, BB revised down the private sector credit growth target to 7.2 per cent, from the previous 9.8 per cent.

Presenting the policy at a press conference, BB Governor Dr Ahsan H. Mansur emphasised the priority of reducing inflation while maintaining exchange rate and financial sector stability.

“Our primary objective remains to bring inflation down to between 3 and 5 per cent, though this will take time,” said Mansur. “Until inflation falls below 7 per cent, we will maintain our current monetary stance.”

Deputy Governor Dr Habibur Rahman formally read out the new policy.

The central bank’s move aligns with the interim government’s macroeconomic targets, which include achieving 5.5 per cent GDP growth and containing inflation within 6.5 per cent in FY26.

In contrast to the reduced private sector credit growth projection, the public sector credit growth target has been revised upwards to 20.4 per cent from 17.5 per cent in the previous policy. This represents a significant increase from 14.2 per cent recorded in December last year.

The MPS also outlines Bangladesh Bank’s continued commitment to stabilising the foreign exchange market. It will maintain active intervention to ensure currency stability and to rebuild foreign exchange reserves.

Commenting on the exchange rate regime, Dr Mansur noted that BB had moved towards a more flexible regime in May 2025 to better manage external imbalances.

“This flexibility remains key to easing market pressures, smoothing external adjustments, and safeguarding reserves,” he said, adding that such adaptability is especially vital amid declining export demand and heightened trade tariffs.

The Governor further highlighted improvements in governance within the banking sector.

“Accountability is being restored, depositor confidence has improved, and the liquidity situation is gradually stabilising,” he added.

However, economists have expressed mixed reactions to the policy. Professor Muinul Islam, a veteran economist, told The New Nation that prioritising inflation control over investment could adversely affect job creation.

“There is an inevitable trade-off between interest rates and employment,” he said. “Nonetheless, controlling inflation must take precedence, but this requires alignment between monetary and fiscal policies.”

Bangladesh Bank also acknowledged several macroeconomic challenges in H1FY26, including persistent inflation, political uncertainty ahead of the next election, sluggish growth, and stagnant private investment. The central bank also identified consistently high levels of non-performing loans (NPLs) as a major concern.