NBFIs reel under rising losses, defaults

Muhammad Ayub Ali :

Bangladesh’s non-bank financial institutions (NBFIs) are facing one of their most challenging periods in recent years, with rising losses, mounting bad loans and eroding public confidence threatening the sector’s stability.

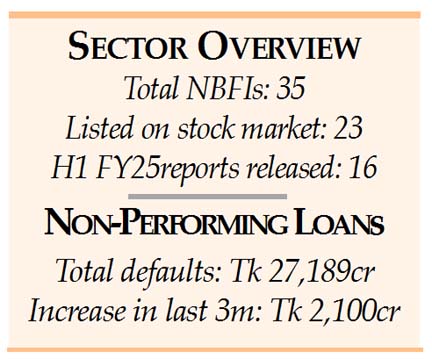

There are currently 35 licensed NBFIs in the country, of which 23 are listed on the stock market. Sixteen have so far released their half-yearly financial statements for the current fiscal year, and the results reveal a stark divide.

According to the reports, ten institutions together posted losses amounting to Tk 1,790 crore – a 17 per cent increase from the same period last year – while six recorded combined profits of Tk 1,780 crore, just enough to offset the overall sectoral deficit.

Bangladesh Bank (BB) data show that defaulted loans in the NBFI sector now stand at Tk 27,189 crore, rising by Tk 2,100 crore in just the past three months, underscoring the sector’s growing vulnerability to non-performing assets.

The financial performance of individual entities highlights the depth of the crisis. Phoenix Finance and Investments Limited reported the heaviest loss of Tk 4,680 crore in the first half of FY2025.

It was followed by People’s Leasing and Financial Services Limited (Tk 1,890 crore) and FAS Finance and Investment Limited (Tk 1,470 crore). Other loss-making institutions include First Finance, Midas Financing, Islamic Finance, Bangladesh Industrial Finance, Union Capital, Bay Leasing, and Fareast Finance.

In contrast, a small number of firms have remained resilient. IDLC Finance Limited posted the highest profit in the sector at Tk 111 crore, followed by DBH Finance with Tk 42 crore. Analysts attribute their relative strength to better corporate governance, stricter risk assessment, and more diversified portfolios.

Experts and stakeholders largely agree on the causes of the downturn: years of poor management, weak internal controls, and financial irregularities that undermined investor trust. Many NBFIs also failed to comply with Bangladesh Bank’s loan classification standards or maintain adequate credit risk management practices, fuelling the rise in bad loans.

In response, the central bank has extended liquidity support to 20 financially weak institutions and is considering restructuring and mergers as part of a broader recovery strategy. However, officials note that NBFIs represent only 5-6 per cent of the country’s financial system, with banks remaining the regulator’s primary focus.

Adding to the uncertainty, seven institutions – including Uttara Finance, Prime Finance, Premier Leasing and Finance, LankaBangla Finance, Investment Corporation of Bangladesh (ICB), International Leasing and Financial Services, and GSP Finance – have yet to publish their half-yearly results.

According to Professor Shah Md Ahsan Habib of the Bangladesh Institute of Bank Management, the crisis reflects deeper structural flaws in the NBFI model. Many depend heavily on short-term deposits to finance long-term loans, creating severe asset-liability mismatches.

For recovery, he argues, Bangladesh must strengthen its capital markets to allow NBFIs to issue long-term debt instruments, reduce dependence on deposit funding, and stabilise their operations. Stronger corporate governance, transparent risk management, and stricter regulatory enforcement, he stressed, will also be essential to restoring public confidence in the sector.