LNG expansion, offshore bids drive energy strategy

Farrukh Khosru :

Bangladesh’s oil and gas sector is undergoing a pivotal transformation as the country strives to maintain energy security and reduce import dependence amidst growing consumption and declining domestic gas production.

A comprehensive new market report titled “Bangladesh Oil and Gas Strategic Analysis and Outlook to 2032” published on Wednesday provides a detailed evaluation of the sector’s current state, key developments, and long-term prospects, underscoring the government’s multi-pronged approach to securing the energy future.

Natural gas still remains the dominant primary energy source in Bangladesh, accounting for more than 60 per cent of the national energy mix.

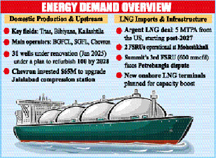

The country has historically relied on domestic gas production to meet industrial, power generation, and residential demand. However, output from key fields – such as Titas, Bibiyana, and Kailashtila – is waning as reserves mature.

To address this challenge, the government has intensified efforts to diversify energy sources, enhance infrastructure, and attract foreign investment into offshore exploration and liquefied natural gas (LNG) imports.

As of 2024 and continuing into 2025, state-owned Petrobangla and its subsidiaries remain at the forefront of managing the upstream, midstream, and downstream oil and gas network. While public enterprises dominate the sector, foreign companies like Chevron maintain a significant upstream presence. To bolster declining domestic output, a national campaign to renovate 100 ageing gas wells by 2028 was launched, with 31 wells already undergoing refurbishment this year.

Meanwhile, offshore exploration is receiving renewed attention. Petrobangla has extended the international bidding deadline for 24 offshore blocks in the Bay of Bengal until December 2025. The extension reflects cautious investor sentiment and the need for clearer regulatory incentives to unlock untapped reserves.

LNG is playing an increasingly crucial role in bridging the supply-demand gap. In early 2025, Bangladesh signed a preliminary deal with Argent LNG for the long-term supply of up to five million tonnes of LNG annually from a planned US liquefaction terminal. Deliveries are expected to begin post-2027, further diversifying the country’s LNG procurement sources and reducing exposure to volatile spot markets.

Chevron also resumed development work at its Jalalabad gas compression station, committing $65 million to extend the operational life of the field. Such investments are vital as declining pressure in ageing reservoirs threatens to reduce transmission efficiency across the national grid.

Midstream infrastructure is being strengthened in parallel. Bangladesh currently relies on two Floating Storage and Regasification Units (FSRUs) at Moheshkhali. Plans to expand LNG regasification capacity include additional onshore terminals and a proposed third FSRU by Summit Group. However, regulatory challenges persist; the project faces uncertainty after Petrobangla issued a termination notice, which Summit is formally contesting.

In the downstream sector, Eastern Refinery Limited (ERL)-the country’s sole refinery-is undergoing modernisation to improve fuel quality and efficiency. Bangladesh’s growing urban population and industrial base are also driving rapid expansion in city gas distribution networks, CNG filling stations, and fuel import terminals.

The newly released strategic report provides granular asset-by-asset data on all operational and planned oil and gas infrastructure, offering forecasts up to 2032. It analyses historic and projected supply-demand trends for crude oil, natural gas, and refined products, and evaluates the implications of recent policy shifts and project announcements.

The study highlights several structural challenges: a reliance on ageing infrastructure, limited private-sector participation in upstream activities, and regulatory uncertainties that hinder faster investment inflow. However, it also points to notable opportunities in offshore gas development, LNG terminal expansion, and midstream modernisation.

A detailed SWOT analysis within the report underscores the sector’s strengths, including an established public sector framework and strategic geographic positioning. Yet it cautions that operational risks, capital constraints, and delays in regulatory reforms could impact the effectiveness of current initiatives.

For investors, the report provides benchmarking data on infrastructure capacity, utilisation rates, and the competitive landscape. Leading players are profiled with insights into their operational performance, market share, and investment strategies.

Bangladesh’s oil and gas roadmap appears increasingly focused on integrated energy planning, with a mix of domestic resource optimisation, infrastructure upgrades, and long-term LNG procurement. While domestic production challenges persist, the government’s push for diversification and modernisation aims to ensure stable energy supply for a fast-growing economy.

With rising energy demand projected through 2032, strategic planning and investment will be essential in sustaining the country’s economic momentum. The report concludes that the success of Bangladesh’s oil and gas sector will depend on its ability to balance domestic production, import flexibility, and regulatory clarity in the coming decade.