51,500 BO accounts lose shares in 7 months

Muhammad Ayub Ali :

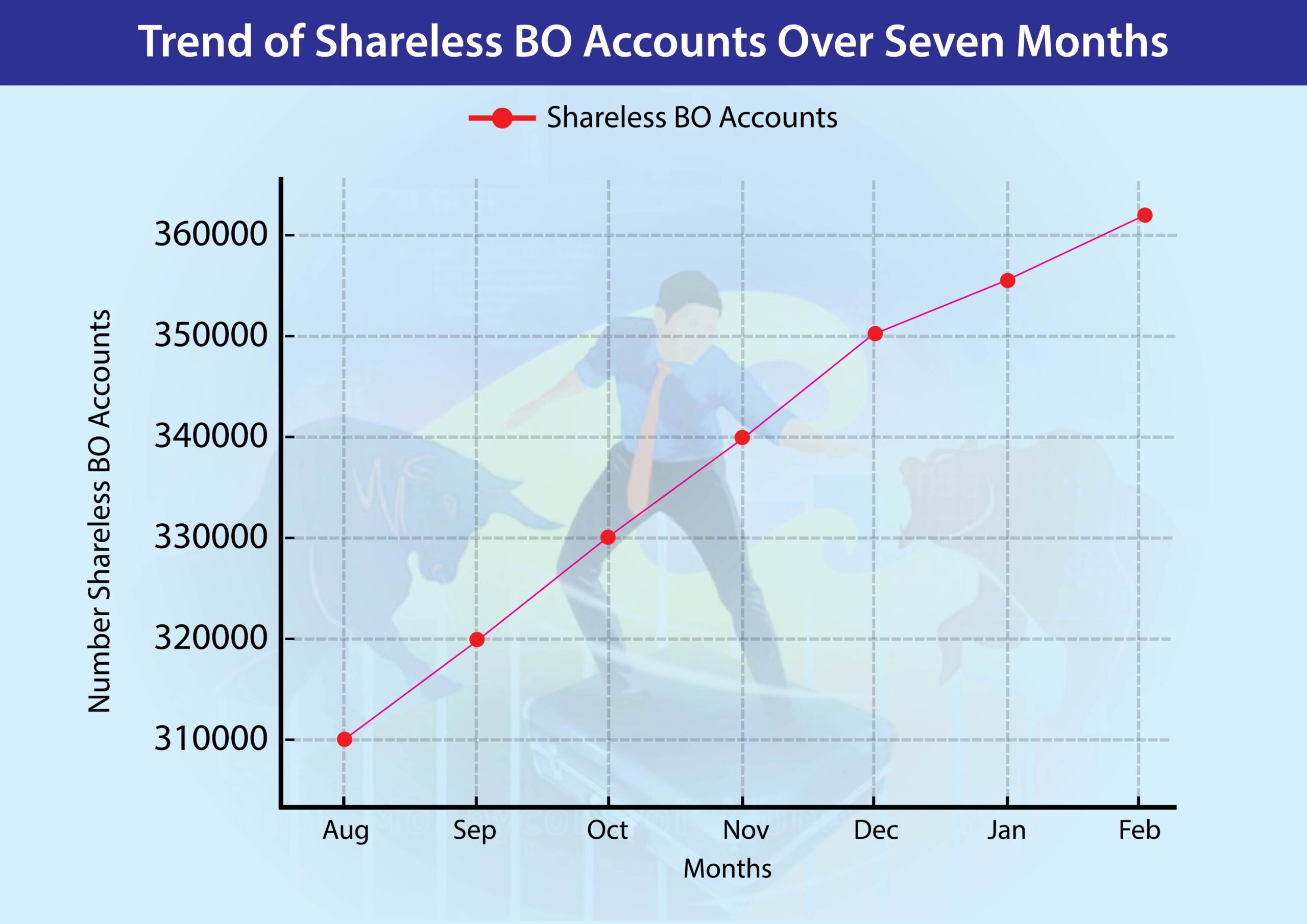

Around 51,549 Beneficial Owner (BO) accounts in the country’s two stock exchanges have become shareless in the past seven months under the interim government, according to data from the Central Depository Bangladesh Limited (CDBL).

Sources indicate that after a prolonged downturn, the stock market showed signs of recovery and positive movement at the beginning of the interim government’s tenure. However, the momentum did not last.

Currently, the number of BO accounts without shares has reached 362,466. In the past two months alone, 17,732 BO accounts have become shareless, including 54 foreign BO accounts that are now inactive.

CDBL data shows that the number of BO accounts held by foreign and expatriate investors now stands at 46,633, compared to nearly 47,083 before the fall of the Hasina-led government.

On August 6, the day after the fall of the Hasina-backed government, there were 310,917 shareless BO accounts. Over the past seven months, this number has increased by 450.

Since August 6, a total of 6,585 new BO accounts have remained unused. At that time, there were around 1,295,768 BO accounts with shares. However, as more shares were released in the past seven months, 38,413 accounts became shareless, reducing the number of active accounts to around 1,257,355.

Despite progress in other economic sectors, the stock market remains sluggish. Even after seven months, it has yet to recover.

Md Saiful Islam, president of the DSE Brokers Association of Bangladesh (DBA), told The New Nation that several factors contribute to the declining stock market participation.

“Firstly, investors are moving towards more lucrative options like bank deposits. Secondly, high inflation has forced people to sell shares to meet their basic needs. Thirdly, investors aim to grow their capital in the stock market, but their investments continue to shrink, making them hesitant to stay in the market,” he explained.

When the interim government led by Dr. Muhammad Yunus took office, many investors hoped for an end to the irregularities, corruption, manipulation, and syndicate trading that plagued the stock market during Sheikh Hasina’s 16-year rule. However, those expectations have not materialized.

Small investors remain frustrated due to ongoing market irregularities and manipulation, with many now worried about losing their investments.