Narrowing dollar gap drives remittance surge

Muhid Hasan :

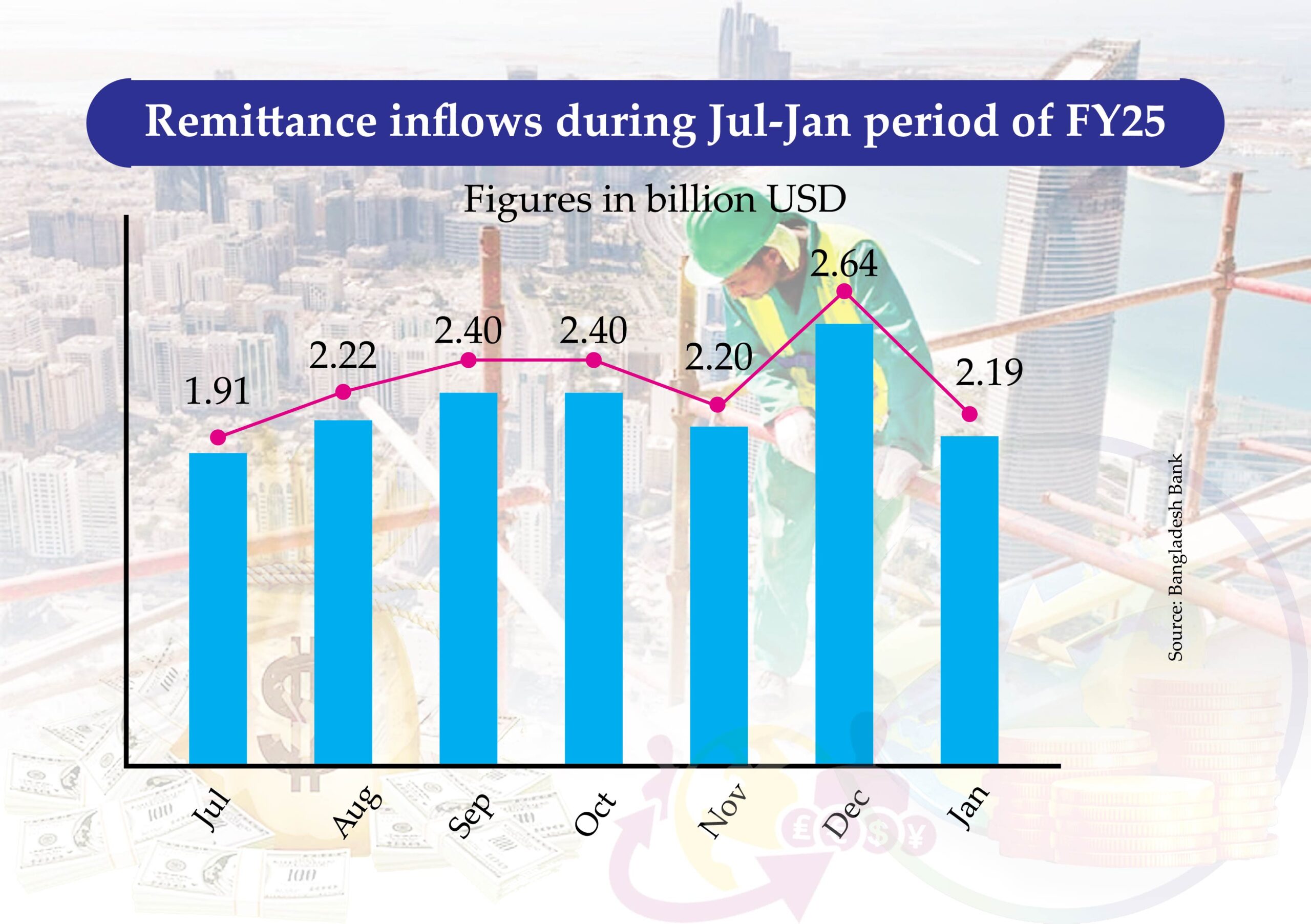

Crosses $2b mark for six consecutive months

Inflow during July-January period reaches 24pc YoY

Bangladesh’s remittance earnings have surpassed the $2 billion mark for six consecutive months, reflecting an impressive 24 per cent year-on-year growth to $15.96 billion in the current fiscal year 2024-25, according to data released by the Bangladesh Bank on Sunday.

During the July-January period of the previous fiscal year, total remittance inflows amounted to $12.91 billion, indicating a $3.05 billion increase over the past seven months.

Experts attribute this surge in inward remittances to the narrowing gap between the dollar rates in formal and informal channels, which has decreased to nearly Tk 1 due to a rise in the official dollar rate. This has incentivised remitters to use legal avenues.

In late December, the central bank verbally instructed banks to cap the maximum buying and selling rate for remittance dollars at Tk 122. Subsequently, on 27 January, the remittance dollar rate rose by at least 50 basis points, reaching Tk 122.5 per dollar.

The demand for hundi (informal money transfer systems) has also declined in recent months, owing to reduced incidents of money laundering, which has further bolstered inward remittances to Bangladesh, experts noted.

Remittance inflows had experienced a decline of 3.2 percent in July, a period marked by political unrest and movements against the Hasina government.

However, inflows rebounded in the following months, with notable increases of 39 percent in August (compared to the same month the previous year), 80 percent in September, and 21 percent and 14 percent in October and November, respectively.

Bangladesh achieved a record $2.64 billion in remittances in December 2024, marking the highest remittance inflow for a single month in the country’s history. According to the central bank, remittance inflows in December 2024 increased by 32.66 percent compared to the same month a year earlier.

In January 2025, Bangladesh recorded a total remittance inflow of $2.19 billion. Analysis of central bank data reveals that state-owned and specialised banks received $627 million in remittances during this period, while private banks received $1.55 billion.

Veteran economist Professor Dr Muinul Islam told The New Nation that the rising inflow of remittances is primarily due to the higher exchange rate and reduced money laundering under the current government.

This has positively impacted the country’s foreign exchange reserves. He also suggested that sending money through formal channels could further increase remittance inflows, as he believes that at least 50 percent of remittances currently arrive in Bangladesh through illegal channels.

Meanwhile, after hovering around the $21 billion mark during the fiscal years 2021-22 and 2022-23, total remittance inflows reached nearly $24 billion in the fiscal year 2023-24.