Inflation unabated, tools ineffective

Reza Mahmud :

Inflation in Bangladesh remains persistent as government measures have failed to curb it, experts have observed. Although December recorded a slight reduction in inflation compared to the previous month, the burden of high commodity and service costs continues to affect the people.

The government has undertaken various initiatives, including the implementation of a tight monetary policy, market monitoring, and anti-hoarding and anti-syndication drives, in an effort to control rising inflation and alleviate public distress. However, these efforts have so far proven ineffective.

Experts have identified several weaknesses in the government’s approach, which have rendered these measures ineffective. For instance, weak market monitoring and collusion between corrupt businesses and regulatory officials have undermined the effectiveness of the programmes.

Additionally, the tight monetary policy, which involves increasing interest rates, has not yielded the desired results due to a lack of coordination with fiscal policy.

While the central bank restricts the release of funds to the public, substantial amounts continue to be spent on development projects, many of which are influenced by political considerations rather than economic priorities.

Furthermore, banks have disbursed large sums through pre-finance and re-finance schemes. According to data from the central bank, Tk 34,218.54 crore was released through such schemes up to 29 December.

Experts argue that while tight monetary policy may restrict the release of Tk 5,000 to 8,000 crore in a given period, the pre-finance and re-finance schemes release significantly larger sums, counteracting the intended effect.

Additionally, Bangladesh Bank is going to announce its Monetary Policy Statement (MPS) for the second half of the fiscal year 2024-25 (FY25) on 27 January.

Experts have also highlighted the role of market syndicates and extortion activities in commodity transportation as major contributors to rising prices. They have recommended taking timely and well-planned measures, including comprehensive market analysis.

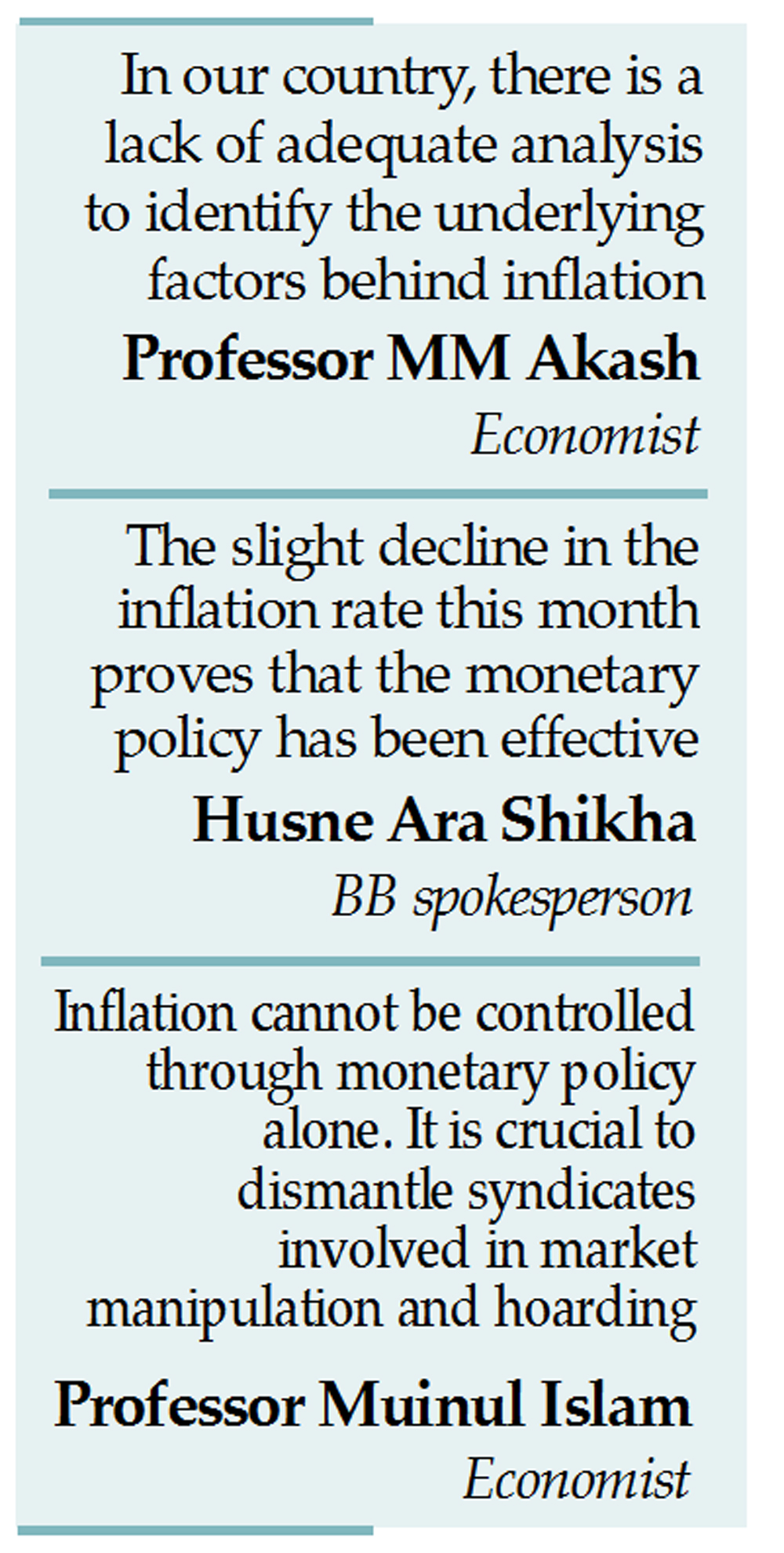

Speaking to The New Nation, eminent economist Professor Muinul Islam stated, “Inflation cannot be controlled through monetary policy alone in Bangladesh. It is crucial to dismantle syndicates involved in market manipulation and hoarding.”

He further pointed out that a section of dishonest officials tasked with market monitoring are colluding with illegal hoarders, which is a significant factor driving inflation.

Another leading economist, Professor MM Akash, told The New Nation, “In our country, there is a lack of adequate analysis to identify the underlying factors behind inflation.”

He explained that inflation occurs when demand surpasses supply and when excess money is available to the public. Additionally, rising production costs also lead to price increases. He suggested that the government should provide subsidies to help contain inflation.

However, the central bank has dismissed such analyses. Husne Ara Shikha, spokesperson and Executive Director of Bangladesh Bank, stated, “The slight decline in the inflation rate this month proves that the monetary policy has been effective.”

She further mentioned that the full impact of the monetary policy would be evident six months after its implementation.

According to the Bangladesh Bureau of Statistics (BBS), the inflation rate fell to 10.89 per cent in December 2024, down from a four-month high of 11.38 per cent in November. Bangladesh experienced high inflation during the first three months of the fiscal year (Q1FY25), with rates of 11.66 per cent, 10.49 per cent, and 9.92 per cent, respectively.

In FY24, the Consumer Price Index (CPI), commonly known as overall inflation, rose by 9.73 per cent, while in FY23, it increased by 9.02 per cent.

In December FY25, price increases slowed in sectors such as food and non-alcoholic beverages (12.92 per cent compared to 13.8 per cent in November), furnishings, household equipment, and routine maintenance (6.96 per cent versus 7.07 per cent), health (5.17 per cent compared to 10.5 per cent), and communication (9.72 per cent versus 9.99 per cent).

However, costs rose faster in sectors such as housing and utilities (9.67 per cent compared to 9.6 per cent), transport (6.08 per cent versus 5.66 per cent), alcoholic beverages and tobacco (17.13 per cent compared to 16.8 per cent), clothing and footwear (9.69 per cent versus 8.99 per cent), recreation and culture (7.92 per cent versus 7.75 per cent), education (9.14 per cent compared to 8.09 per cent), restaurants and hotels (12.13 per cent versus 11.04 per cent), and miscellaneous goods and services (14.85 per cent compared to 14.78 per cent).