State-run banks dominate 72pc provision deficit

Staff Reporter :

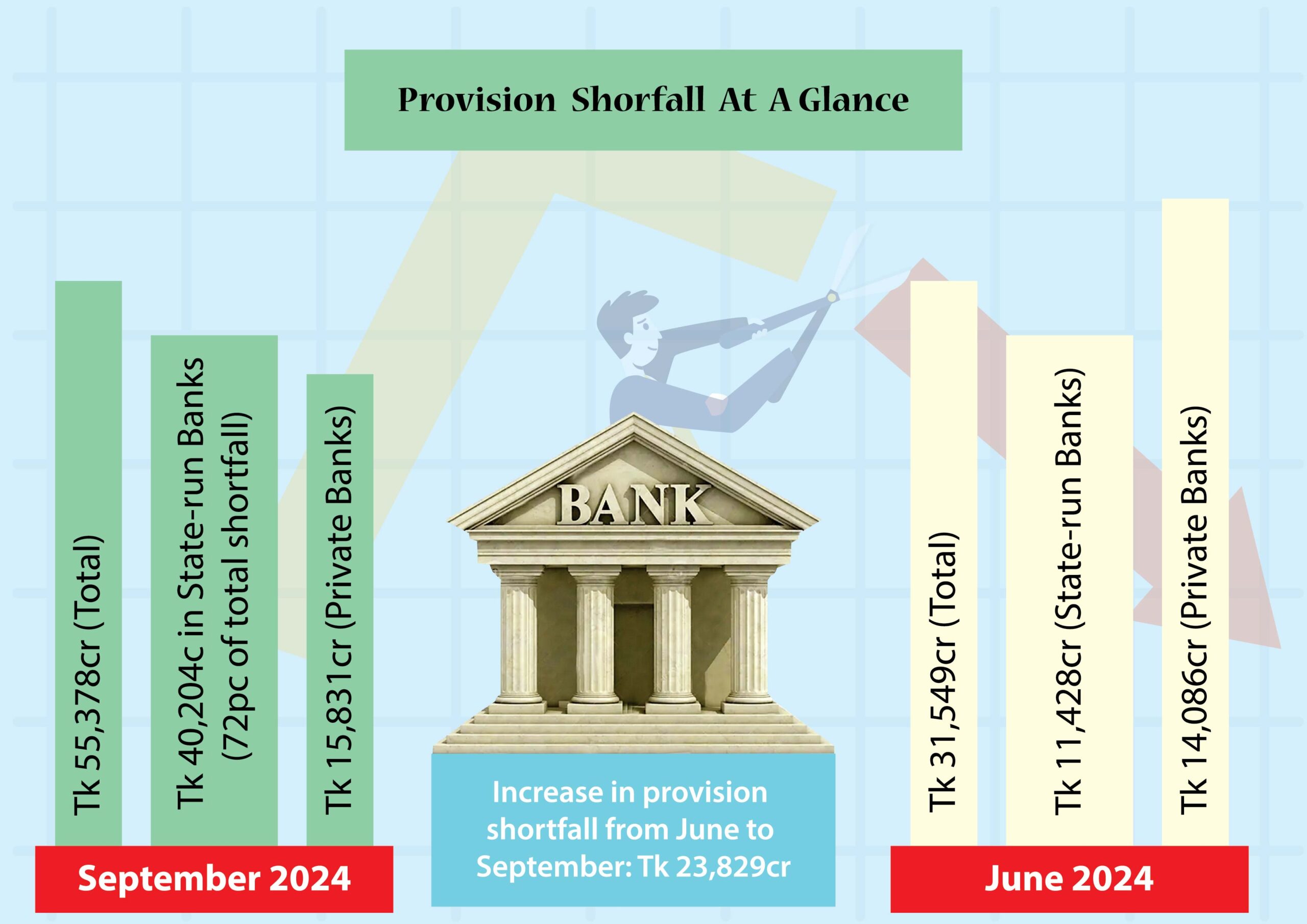

The provisioning-fund deficit against bad assets in Bangladesh’s banking sector surged to Tk 55,378 crore in September, a significant rise from Tk 31,549 crore in June, driven by an increase in classified loans across both state-run and private commercial banks.

State-owned banks accounted for 72 per cent of the total shortfall, with their deficit escalating to Tk 40,204 crore in September, a threefold increase compared to Tk 11,428 crore in June. Similarly, the provision shortfall in private banks rose by Tk 1,745 crore, reaching Tk 15,831 crore during the same period.

Data from the central bank indicates a worrying trend, as the provision shortfall in the banking sector grew by Tk 4,963 crore between April and June. By the end of March this year, the shortfall stood at Tk 26,586 crore.

A Bangladesh Bank report revealed on September 6 that provision shortfalls have been exacerbated by rising default loans. Ten banks, including National Bank, BASIC Bank, Agrani Bank, Rupali Bank, and Southeast Bank, reported a combined deficit of Tk 31,549 crore as of June.

Provision shortfalls occur when banks face high levels of non-performing loans (NPLs). These shortfalls reduce net profits, negatively affecting shareholder dividends.

The total volume of NPLs in the country’s banking sector has reached a record Tk 2,84,977 crore, approximately 17 per cent of total outstanding loans, as of the July-September quarter of FY2024 (Q3FY24).

The banking system currently holds Tk 1,682,800 crore in outstanding loans, according to Bangladesh Bank statistics released last week.

This marks the highest volume of bad loans in the nation’s history, with NPLs increasing nearly twelvefold over the past 15 years. During Q2FY24, NPLs stood at Tk 2,11,391 crore, reflecting an alarming rise of Tk 73,586 crore in just three months.

State-owned banks account for Tk 1,26,111 crore in defaulted loans, representing 40.35 per cent of their disbursed loans, while private commercial banks reported NPLs of Tk 1,49,806 crore, or 11.88 per cent of their total disbursed loans. Specialized banks reported defaulted loans of Tk 5,813 crore.

Banks are required to reserve 0.50 per cent to 5 per cent of their operating profits for provisioning against general-category loans. The requirement increases to 20 per cent for loans classified as substandard, 50 per cent for those in the doubtful category, and 100 per cent for loans deemed bad with a high risk of loss.

The soaring provision shortfalls underscore the urgent need for stronger measures to address rising NPLs and improve financial discipline in the banking sector.