Nat’l budget to be placed today

Al Amin :

Finance Minister Abul Hassan Mahmood Ali is set to place a possible Tk7,97,000 crore national budget for the next fiscal year (2024-25) in The Parliament today (Thursday) amid the growing challenges of containing inflation, maintaining a sound foreign currency reserve, a stable exchange rate and generating more revenues.

This will be the country’s 53rd budget and the 25th of the Awami League (AL) government in six terms and will also be the 21st under the rule of Prime Minister Sheikh Hasina in different terms. Besides, the budget will be the first for the present Finance Minister.

The government has scaled back its ambitious budget for the upcoming fiscal year due to lower-than-expected revenue collections and conditions tied to loans it is expected to receive from the International Monetary Fund (IMF).

The budget is going to place at a time when the country’s economy is going through a rough patch like never before in the past decade and a half. Growth slowed, inflation surged, real wages fell, foreign exchange reserves dwindled, financial sector stressed, private investments stagnated, and the external environment did not help.

Amid the global volatile condition and adversities, the finance minister is eying a 6.75 per cent GDP growth while containing the inflation at 6.50 per cent although the general point to point inflation is still hovering slightly below the double digit mark albeit various efforts from the government to tame inflation.

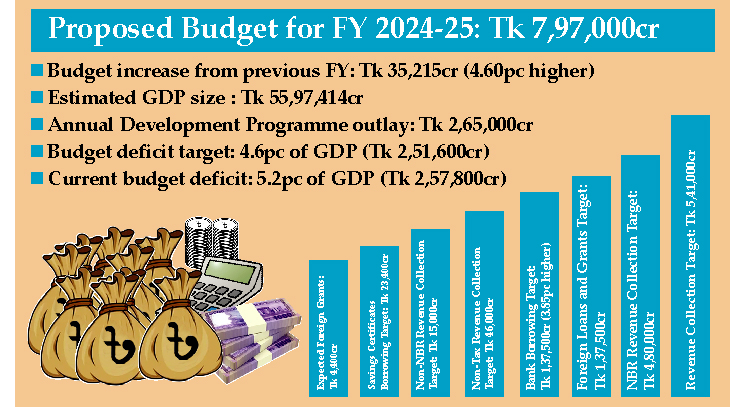

The finance ministry officials said the possible budget size of Tk7,97,000 crore would be 4.60 per cent or likely around Tk 35,215 crore higher than the budget of the outgoing fiscal year (FY24).

The country’s GDP size has been estimated at Tk 55,97,414 crore.

Apart from the already approved Annual Development Programme (ADP) outlay of Tk 2,65,000 crore.

As the government wants to lower expenses, it is likely to contain the budget deficit to 4.6 per cent of the GDP in the next fiscal year. The government usually keeps the budget deficit at around 5 per cent.

Facing a significant fund shortage to bridge the budget deficit, foreign loan repayments on major infrastructure projects, such as the Padma Bridge, tunnel, metro rail, and Ruppur Nuclear Power Plant, are projected to increase by 40 per cent in the next fiscal year.

To manage these repayments, the government plans to raise approximately Tk 5,45,400 crore from domestic sources, a 9.8 per cent increase over the current fiscal year’s target.

According to government projections, 68.43 per cent of total budget expenditure will be sourced internally, with the remaining 31.57 percent coming from both domestic and foreign loans.

The budget deficit is projected to exceed Tk2,51,600 crore, or 4.5 per cent of GDP, compared to Tk 2,57,800 crore, or 5.2 per cent of the GDP, in the current fiscal year. This represents a 2.44 per cent reduction in the deficit compared to the previous year.

The finance division estimates Bangladesh’s GDP will reach nearly Tk55,97,400 crore in the next FY, an 11.80 per cent increase from the current fiscal year.

To address the shortfall, the government aims to secure over Tk 1,37,500 crore from foreign loans and grants in the next budget, up from Tk 1,27,200 crore in the current year. Consequently, foreign debt is expected to rise by 8.11 per cent to Tk 10300 crore 10 lakh.

Experts predicted that the government’s expenses will double in the next fiscal year due to increased interest and installment payments on foreign debt.

Foreign loan repayments are projected to be Tk 36500 crore, a 48 per cent increase from the current fiscal year’s estimate of Tk 24700 crore.

The government plans to borrow Tk 1,37,500 crore from the banking sector, 3.85 per cent higher than the outgoing fiscal year and Tk 23,400 crore from savings certificates, up from Tk 23,000 crore.

Policy Research Institute Executive Director Ahsan H Mansoor emphasised on the necessity of foreign aid to address the country’s dollar deficit.

“To implement the budget, foreign funds are essential. Therefore, government officials must continue negotiations with international organizations,” he told The New Nation.

The finance ministry officials said the government this time is neither pursuing a high and ambitious growth nor taking fresh mega projects.

Besides, there will be added pressure on repaying principal amounts and interests against foreign loans for which the National Board of Revenue (NBR) would put higher emphasis on generating more revenues.

To face the expenditure pressure, the government will eye for realizing overall revenue of Tk5,41,000 crore of which the revenue board alone would be entrusted with collecting Tk 4,80,000 crore which is Tk 50,000 crore higher than the outgoing fiscal year.

Apart from the NBR, the government will strive to collect Tk 15,000 crore as non-NBR revenue while Tk 46,000 crore as non-tax revenue.

Besides, Tk 4,400 crore is expected to come as foreign grants.

Dr Salehuddin Ahmed, former Bangladesh Bank Governor, said, “The government should prioritise foreign currency management and expanding the social safety net sector to curb the escalating inflation in the country.”

He believes the government faces five challenges – curbing inflation, increasing foreign currency reserves, improving good governance in the banking sector, boosting revenue generation, and enhancing budget implementation capacity.

And to confront these challenges, he recommended focusing on small and medium industries that unleash employment and emphasized on avoiding large-scale infrastructure projects to prevent financial mismanagement and increasing workers’ wages.